Watch the video extracted from the WLGC session before the market open on 12 Mar 2024 below to find out the following:

Video Length: 00:09:22

Market Environment

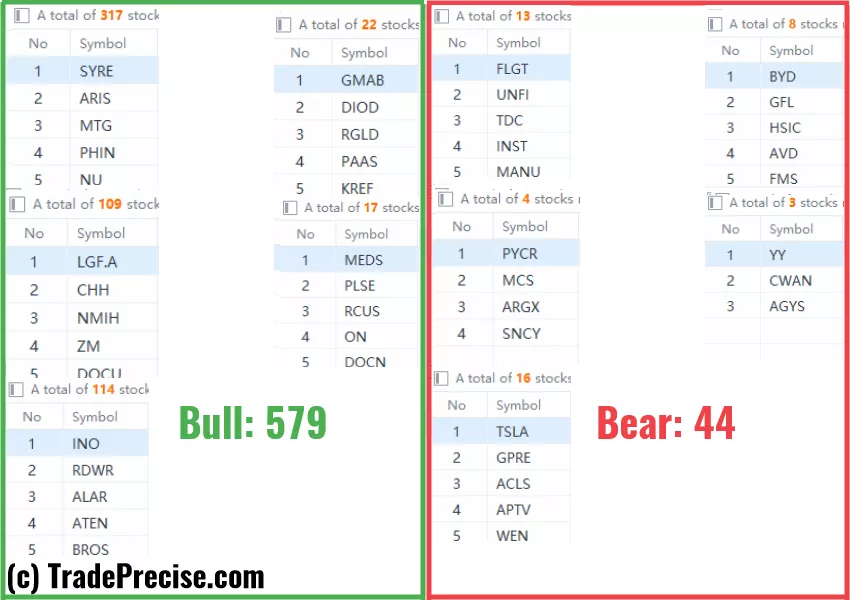

The bullish vs. bearish setup is 579 to 44 from the screenshot of my stock screener below. There is no shortage of bullish setups despite the market has been extended for months.

Market Comment

Pay attention to the key support level as discussed in the video. A violation of this support level is likely to trigger either a shakeout or a market rotation (more obvious) in the S&P 500.8 “low-hanging fruits” (PPC, TDW, etc…) trade entries setup + 20 actionable setups (QTWO etc…) have been discussed during the live session before the market open (BMO).

More By This Author:Looming Threat Of A Rising Wedge

The NVDA Earnings Effect And What It Means For The Current Market Momentum

Is The Stock Market Ready To Plunge? The Warning Signs Are Here

Leave A Comment