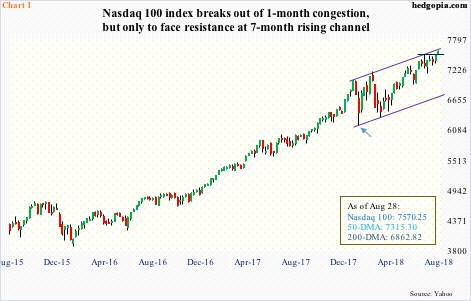

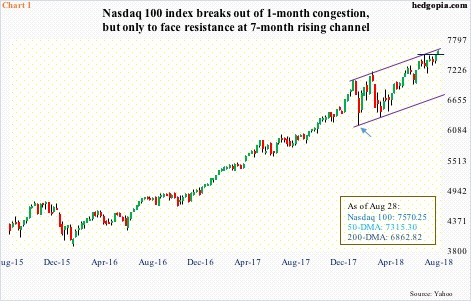

The Nasdaq 100 index enjoyed a mini-breakout Tuesday, only to find itself right underneath seven-month channel resistance. A breakout would be massive. Could shorts come to longs’ rescue in due course?

The tech-heavy Nasdaq 100 (7570.25) Tuesday rose to yet another high. Through the session’s intraday high of 7588.72, it was up 18.6 percent for the year. Monday, the index broke out of one-month consolidation. This followed consistently higher lows since the February low (arrow in Chart 1).

The 1.1-percent move week-to-date also puts the index right underneath channel resistance, which goes back to late January this year. In the very near-term, digestion of these gains is the path of least resistance. In the past couple of sessions, the index closed above the daily upper Bollinger band. Conditions are overbought, with some weekly momentum indicators way extended. The channel resistance likely holds near term.

But what if? What if the index in due course breaks out of the channel? Since late June, the 50-day moving average has been tested twice, and on both occasions, bulls stepped up. The average lies at 7315.30, which also approximates two-plus-month support at 7300. A test looks imminent near-term. If the average is once again defended, will shorts give up? Better yet for the bulls, will shorts be squeezed enough to sling the index out of the channel?

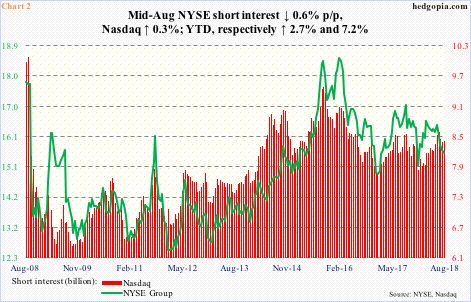

This is not a base case on this blog, but it does not hurt remaining cognizant of its possibility. Short interest remains high.

By mid-August, Nasdaq short interest is up 7.2 percent this year, versus a 2.7-percent rise on the NYSE Group. Shorts are increasingly tempted by the peer-beating rally in the Nasdaq, which is well ahead of its major US peers. Year to date, the Composite is up 16.3 percent. In contrast, the Russell 2000 small cap index is up 12.6 percent, the S&P 500 large cap index up 8.4 percent, and the Dow Industrials up 5.4 percent.

At 8.4 billion by mid-August, Nasdaq short interest is not as elevated as during September 2015 or February 2016, but high enough (Chart 2). Last year, as stocks began to rally in Q4, short interest fell from 8.5 billion mid-September to 7.8 billion by the end of December. This is what the bulls are hoping for, provided they can force a squeeze.

Leave A Comment