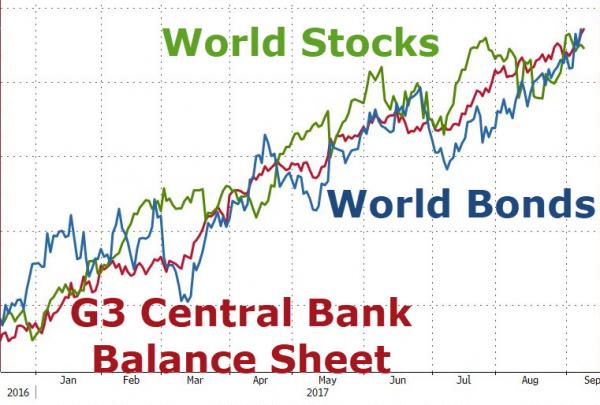

Last week, former fund manager Rich Breslow made it clear that “the only thing standing between this being full-blown panic versus the frenetic gyrations we’re seeing is the central bank put.” He is, of course, correct. One glimpse at the following chart tells you all you need to know about ‘trading’ in these ‘markets’.

However, as Breslow explains today, it’s not what central banks have done that matters… but what they’re about to do – and that may change the discussion dramatically…

Via Bloomberg,

I was reading a note warning traders to avoid focusing on what policy makers should do and concentrate their efforts on sussing out what they will do. Both are interesting questions, deserving of discussion. And they also share the trait of being equally unhelpful when trying to make money. The only reliable way to have a consistently high Sharpe ratio is to figure out what the important (read “big”) players will be up to–and then get in front of them. Get that right and what happens down the road becomes largely irrelevant.

Leave A Comment