One week ago, and just days before Kolanovic again warned – correctly – that a market slump is imminent, JPM’s “other” Croat, Mislav Matejka said to “Use Any Bounces As Selling Opportunities.” Any bulls who listened to him are in less pain than those who didn’t. So what does Matejka think now that all indices are in correction territory and a majority of stocks are in a bear market?

The short answer: an oversold bounce is imminent. Here’s why:

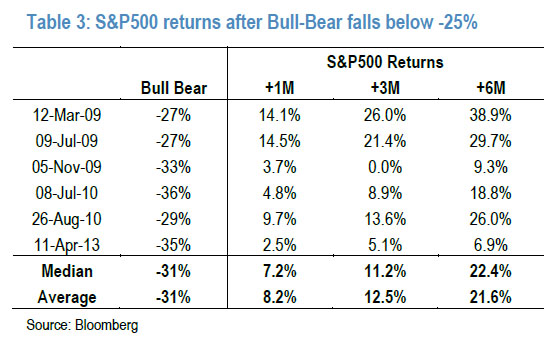

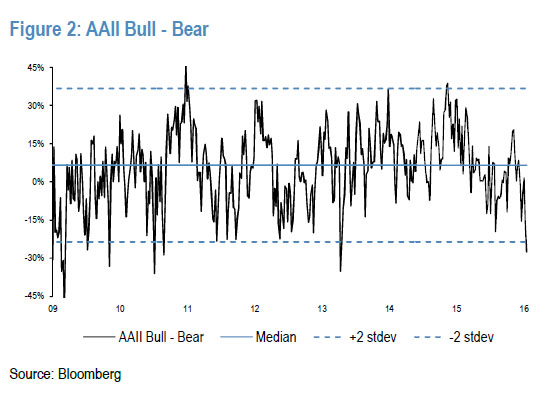

A number of tactical indicators we follow are suggesting the market is getting close to being oversold in the very short term. The Bull-Bear spread hit -28%, one of the lowest readings since March ’09.

Over that period, every time Bull-Bear moved to this level, equities were up on 1, 3 and 6 months.

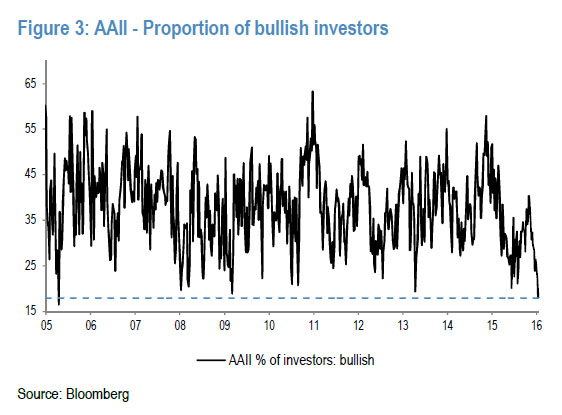

Within the survey, the proportion of bulls fell to the lowest level since ’05.

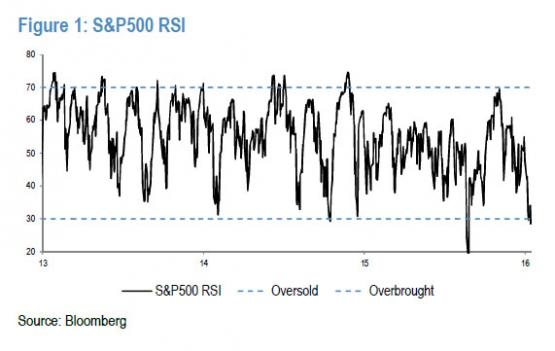

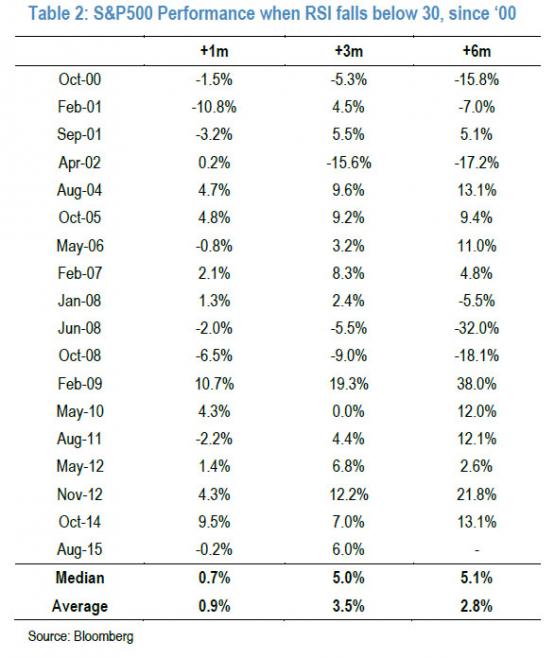

Also, S&P 500 RSI last week dipped below 30, to oversold territory.

Equities were on average up 4% over the next 1 month, on most occasions, from these levels of RSI.

Finally, Macro HF beta has moved closer to zero – suggesting that investors have de-risked.

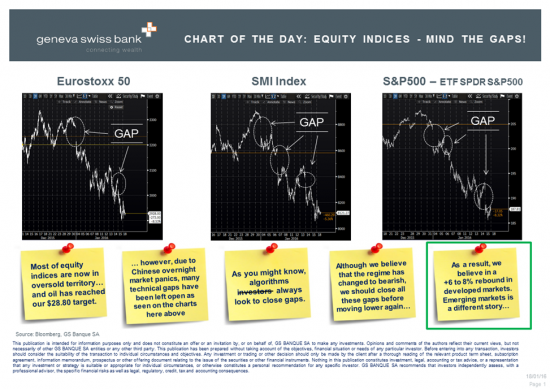

To be sure a rebound higher to close the “gaps” is also the current case of Loic Schmid, head of asset management at Geneva Swiss Bank, who anticipates a 6-8% rebound higher, in line with JPM’s expectations.

And just to make sure the pile-in is complete, here comes DB’s David Bianco calling for a 5% bounce in the S&P at the same time as his credit colleagues are saying the 10Y will close the year at 1.75% (instead of 2.00% as they predicted previously):

We are not panicked by this correction because we understand it. It’s driven by a profit recession centered at certain industries caused by factors that we’ve long flagged as risks with detailed research and quantified sensitivities. We’re prepared for assessing recent developments, including the likely limits to S&P EPS damage. Our advised strategy helped to shield investors from this correction, particularly the structural revaluation of Energy & many Industrials, but this correction has overly punished other sectors and now we’re ready to take advantage of it. We expect the Next 5%+ S&P price move to be up and soon. We reviewed our S&P target, EPS and valuation models and find that only a 50 point cut to our 2016 end S&P target to 2200 is warranted.

Leave A Comment