German airline group Deutsche Lufthansa (FRA:LHA) has recently suffered several blows to its financial performance, with certain headwinds unlikely to abate in the near-term.

Lufthansa posted less-than-stellar earnings results for the first nine months of 2018.

The firm generally blamed higher fuel costs, flight delays and cancellations, as well as merger-related integration expenses and losses at its discount carrier Eurowings, for its downbeat performance.

For the first three quarters of 2018, the Cologne-headquartered company said it earned €2.4bn, a 7.7% drop from the prior-year period, on the back of almost €27bn in total revenues.

Apart from geopolitical risks facing the global aviation industry, including Brexit and Italian government spending and policy, European airliners have generally been hampered by fierce competition and higher oil prices.

Lufthansa chair and CEO Carsten Spohr said he expects full-year costs to rise by over €1.0bn in 2018, underscored by a fuel bill that had increased by €536m in the first nine months of 2018.

While oil prices have fallen recently, sentiment may very well reverse as U.S. sanctions on Iranian crude are set to come into effect on November 4.

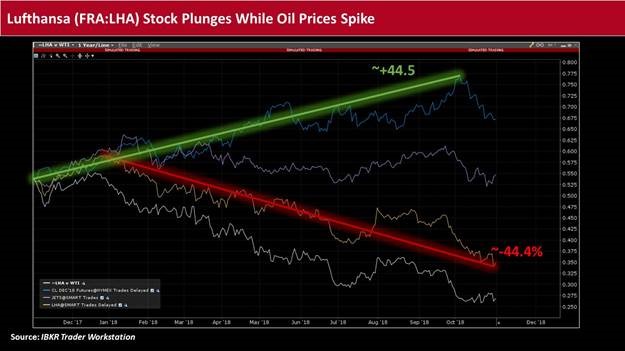

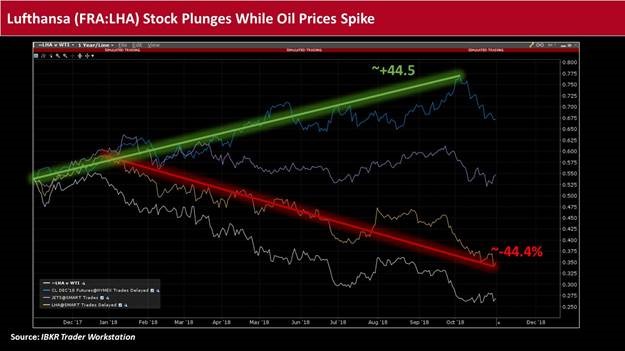

The active crude oil futures contract was last trading at a little above US$66.40 intraday Wednesday, a decline of nearly 12.9% from its 52-week high of US$76.25 set in early October. Crude had risen more than 44.5% over the past year, driven in large part by uncertainties over Iran’s supply contributions, as well as global trade disputes.

Lufthansa anticipates an €850m rise in fuel costs this year compared to 2017 and by a further €900m in 2019.

Traffic control

European airliners face an increasingly congested market, which has spurred a groundswell of consolidation, with rising oil prices attributed to accelerating the recent insolvency of several players, including Primera Air, Switzerland’s Skyworks, and Belgium’s VLM.

Leave A Comment