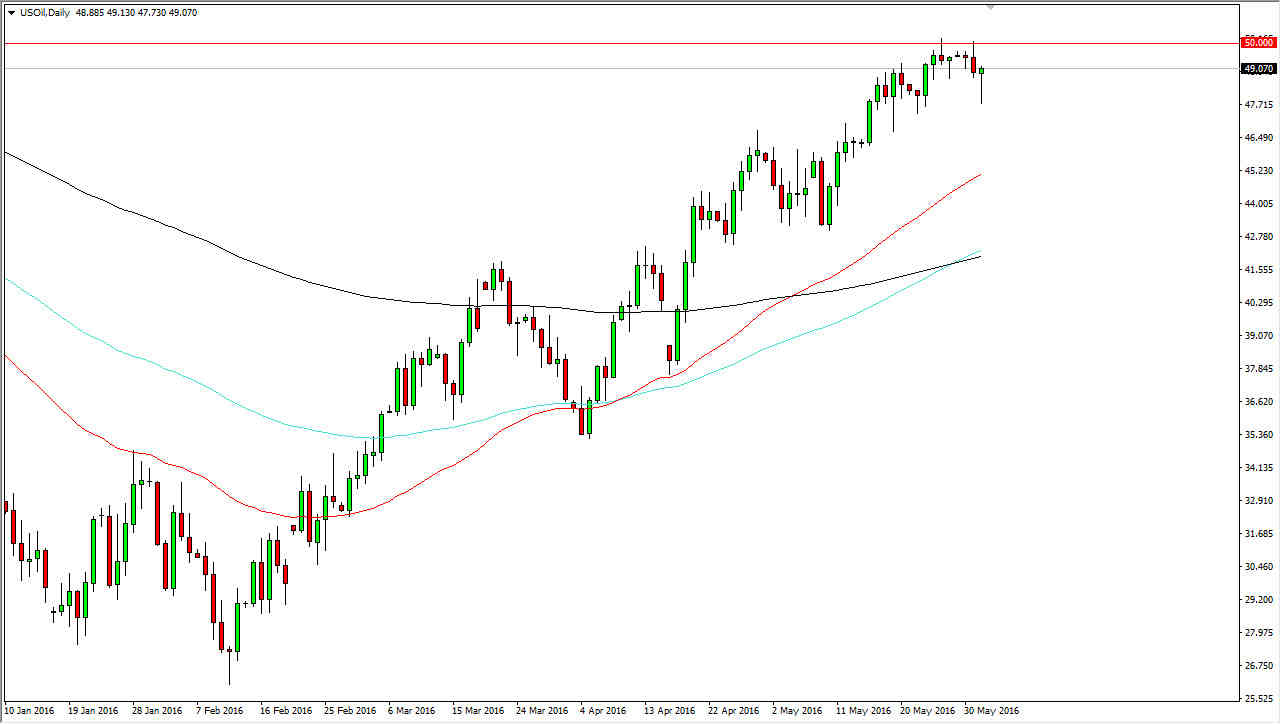

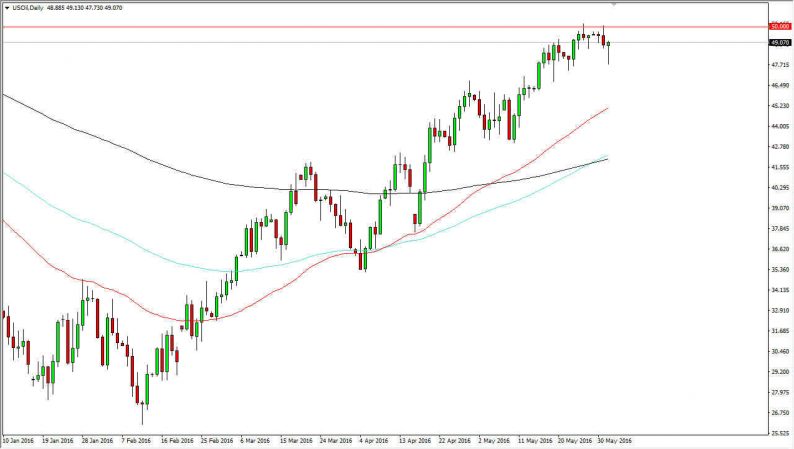

WTI Crude Oil

The WTI Crude Oil market initially fell on Wednesday but turned right back around to form a bit of a hammer. That of course is a very bullish sign, and I think that it shows that we are simply trying to build up momentum to finally break above the $50 handle. If we get that move, this market could very well enter a longer-term “buy-and-hold” situation on even higher time frames. On the chart, you can see that I have a black moving average which is the 200 day exponential moving average, which recently has been cross by both the 50 and the 100 day moving averages. This shows that we are trying to make a significant move higher from the longer-term perspective, and at this point in time I have no understand selling.

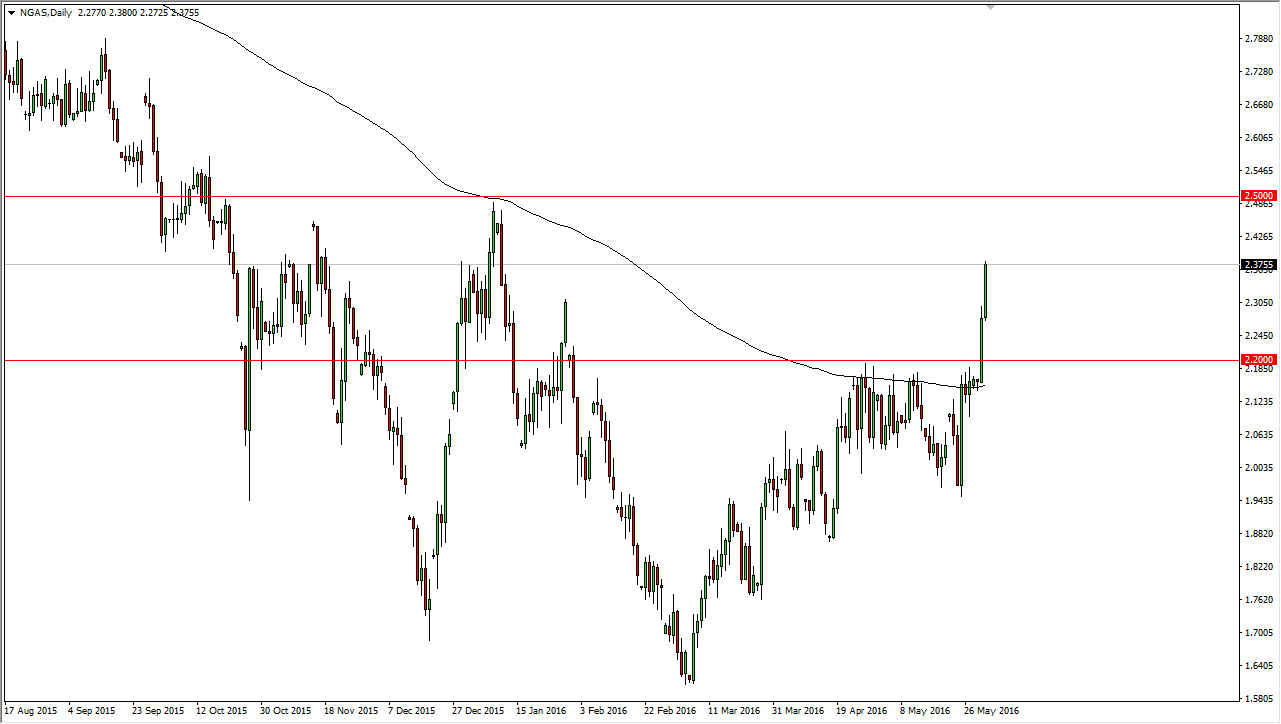

Natural Gas

Looking at this chart, it’s pretty amazing how far we have come in just a couple of days. We broke through the $2.20 level, which of course was bullish and then shot straight up in the air. I think at this point in time were going to target the $2.50 level which is the next natural “big figure.” However, I don’t necessarily think we do it in one shot. If we get an exhaustive candle, it could be a selling opportunity but quite frankly the natural gas markets have a lot of negativity to them as sooner or later drillers will come back into the marketplace and start selling on higher prices. In other words, even though we have a “rip off your face” type of rally going on right now, I still think it’s only a matter time before the sellers get involved. This is a market that has been very good to sellers for a very long time, so this significant bounce isn’t much of a surprise. Given enough time I think the sellers returned, but very obviously the buyers are in control at the moment.

Leave A Comment