WTI Crude Oil

The WTI Crude Oil market fell significantly during the day on Thursday, testing the $50 level for support. We found it, and turned around to form a bit of a hammer. The hammer of course is a bullish sign, so I think we could bounce from here and try to go towards the $52.50 level above. We have plenty of volatility and choppiness in this market, as well as confusion. Because of this, it can be difficult to hang on to this market, as the noisy conditions make this a very tough market to hang onto. However, I think that we have several conflicting issues at the same time, as OPEC and more importantly, Saudi Arabia and Russia have come to the conclusion that they are going to try to cut back on production. On the other hand, it’s likely that oversupply will continue to be a major issue. With this, noise continues to be an issue.

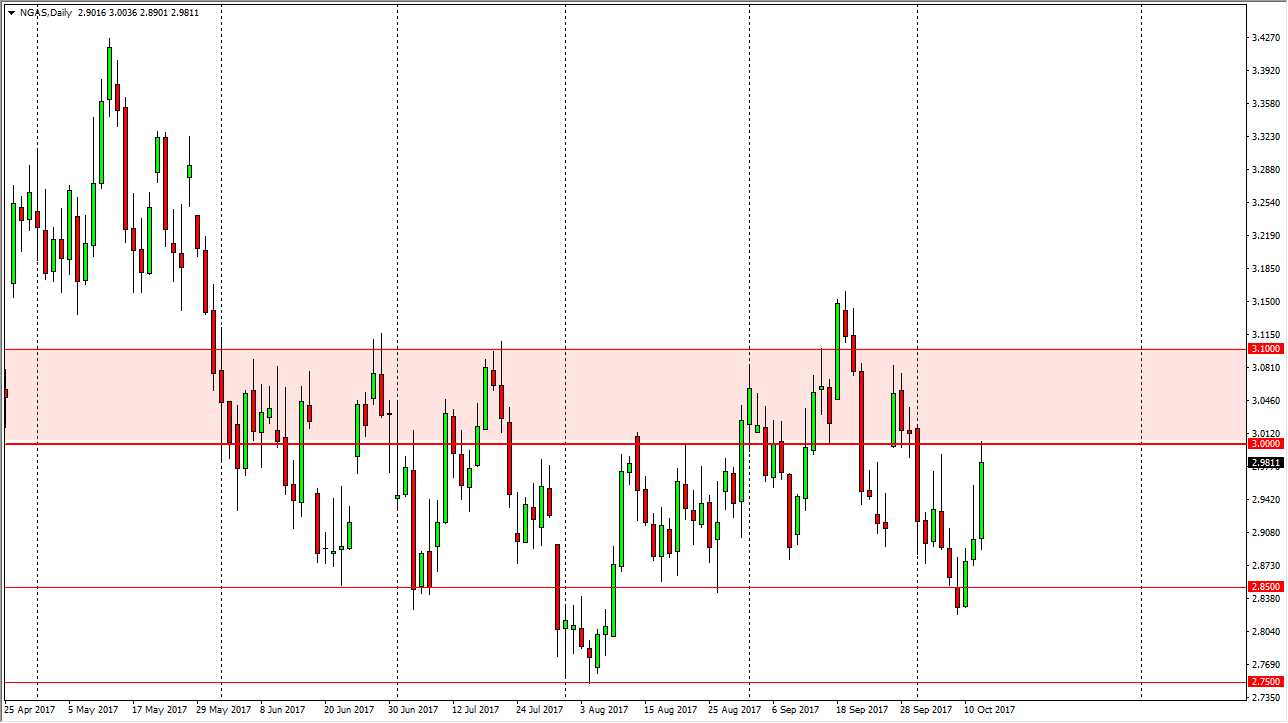

Natural Gas

The natural gas market broke higher during the Thursday session, slamming into the $3.00 level. This is an area that begins a significant amount of resistance, as crude oil drillers and suppliers find themselves profitable again. Because of this, I think it’s only a matter of time before the sellers come back out and start flooding the market with supply. Because of this, I’m waiting to see some type of exhaustive candle to start shorting, perhaps on shorter time frames. At that point, I expect the market is probably going to go back down to the $2.85 level, as we continue to see plenty of volatility in this market, but more importantly far too much in the way of oversupply. Ultimately, this is a market that gives us plenty of opportunity to short if we can be patient enough.

Leave A Comment