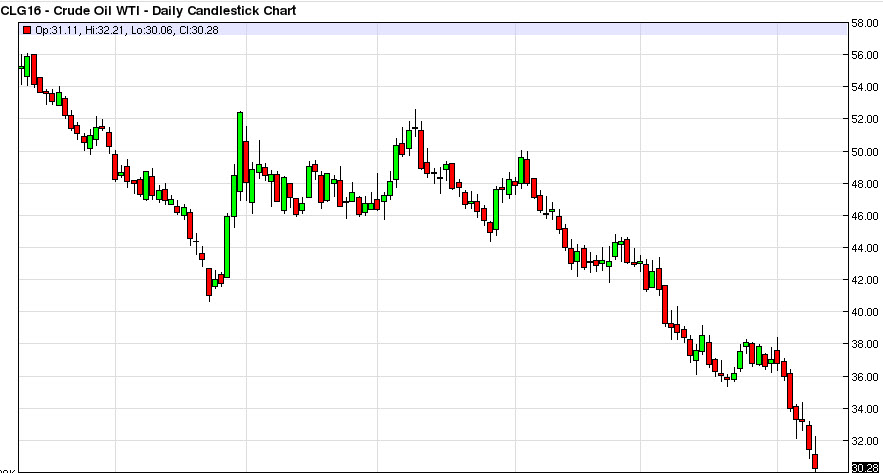

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Tuesday, but found the $32 level to be far too resistive to continue to go higher. Because of this, we turned back around to form a shooting star, which of course is very negative. This is especially negative when it is at the bottom of the downtrend. We currently see the $30 level as support below, but I feel that it’s only a matter of time before we break down below there. If we rally from here, I would anticipate sellers to reenter this market, as there is more than enough resistance above to keep the market down. The $36 level above should be essentially a “ceiling” in this market, and as a result rallies offer value in the US dollar far as I can see.

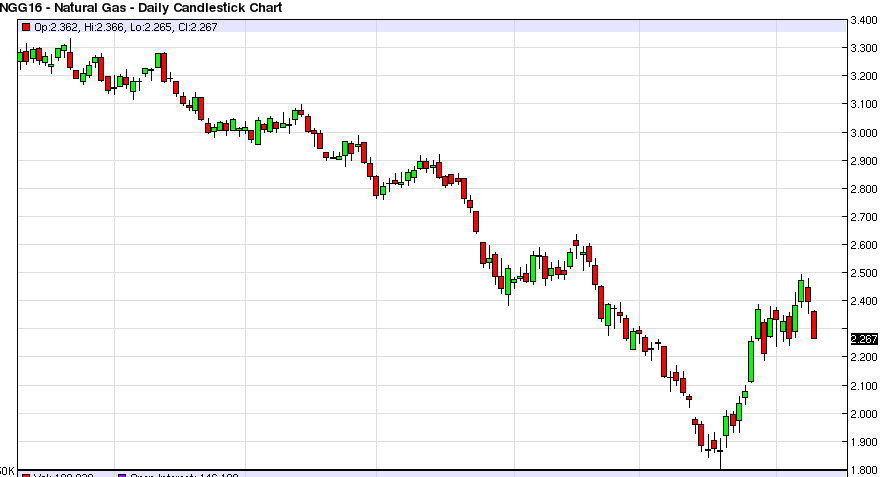

Natural gas

It appears that the natural gas market is trying to break down from here, and if we can go below the $2.20 level, I feel that we will more than likely try to reach towards the very bottom yet again. After all, we have recently attempted to break out above the trend line that had been the resistance driving this market lower. Because of this, and the fact that we gapped lower at the open on Tuesday suggests that the sellers are going to continue to run this market.

At this point in time, I feel that the supply will continue to be the biggest problem for this market, as the demand simply cannot wait it out. After all, it is just now getting cold in America, a full 2 months later than natural gas markets hope for. Because of this, it’s only a matter of time before the sellers take over again in my opinion, and it is not until we clear the $2.50 level, or more importantly the downtrend line, that I would be interested in buying.

Leave A Comment