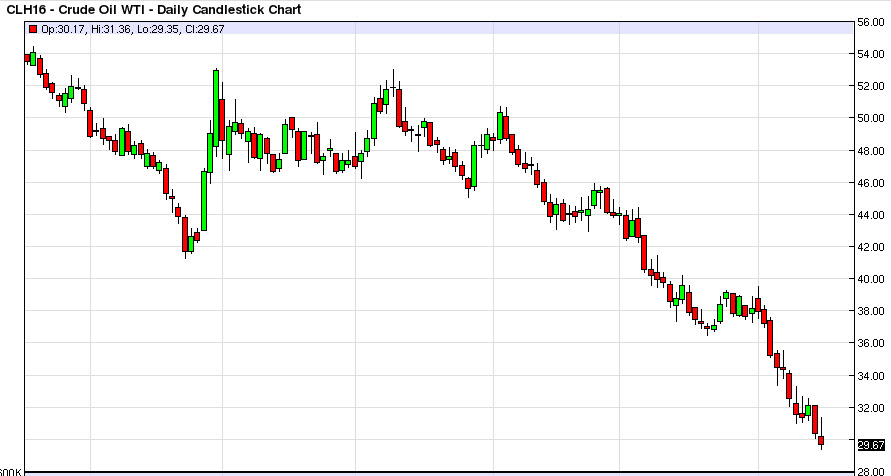

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Tuesday, reaching as high as $31.50 during the day. However, we turned back around to form a massive shooting star, which of course is a very negative sign. The shooting star suggests that we are going to see some type of continuation, and as a result I think that the market will offer plenty of selling opportunities on rallies when it comes to short-term charts. I also believe that we can break down below the bottom of the shooting star instead, and when we do the market should then start dropping from there as well. At this point, I have no scenario in which I’m willing to start buying this market, because quite frankly I think the $32 level is starting to show itself as rather resistive. At this point in time, I believe that the market is probably going to trying to reach the $25 handle.

Natural Gas

The natural gas markets initially tried to rally as well, but struggled at the $2.15 level, and turned back around to form a shooting star. The shooting star of course is a very negative sign and a break down below the bottom of it is a classic signal that I use quite a bit to enter downtrend. Simply put, the shooting star suggests that the buyers tried to push this market higher, but failed. I think at this point in time we will reach towards the $2.00 level, and then lower than that towards the $1.80 level.

I have no interest in buying, because quite frankly the downtrend line that coincided with the $2.50 level showed just how resistive this market is overall. The bounce was impressive of course, but at the end of the day it was essentially a “dead cat bounce” in a market that has been selling off drastically. I think it continues.

Leave A Comment