RBOB has given up its post-API gains and RBOB is sliding into the DOE data but both jumped as Gasoline inventories drew down and crude’s build was bigger than the whisper number. Production jumped to a new record high.

Notably, Bloomberg Intelligence Energy Analyst Fernando Valle points out that the prospect of a trade war raised by U.S. President Donald Trump is narrowing distillate crack spreads even as demand remains robust. The fear is that a dispute would dampen industrial activity, reducing demand for diesel fuel that powers trucks and machinery.

API

Crude +5.66mm (+3mm exp)

Cushing -790k exp

Gasoline -4.536mm – biggest draw since Oct 2017

Distillates +1.487mm

DOE

Crude +2.408m (+3mm exp, whisper +2mm)

Cushing -605k (-600k exp)

Gasoline -788k (+1mm exp)

Distillates -559k

Inventories are just 2% above the five-year norm, with Cushing stockpiles more than 45% below the average.

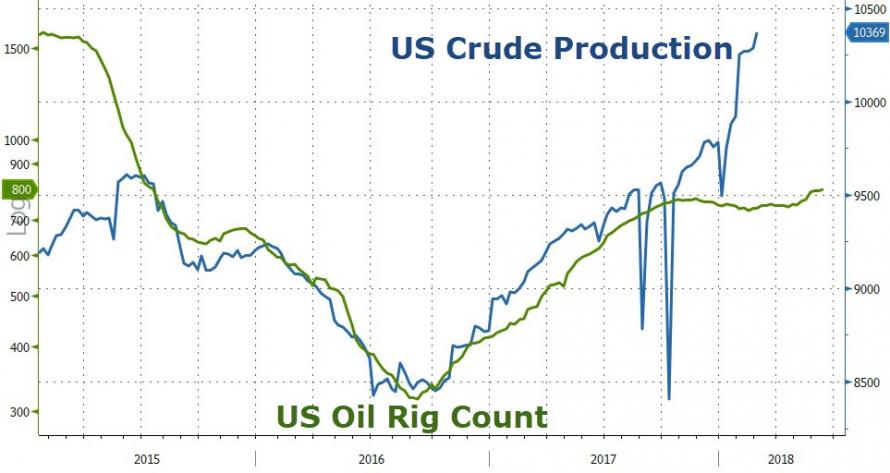

All eyes are again on US crude production after EIA upped its forecasts and OPEC begged for Shale to stop… but production jumped 86k last week to a new record high…

Despite a kneejerk higher after API’s big gasoline draw, RBOB has pushed lower along with WTI ahead of the DOE data, but both rebounded after (though RBOB is fading the initial jump)

“Oil fundamentals have been showing signs of weakening,” said Ole Sloth Hansen, head of commodity strategy at Saxo Bank A/S in Copenhagen. “Strong non-OPEC oil-production growth looks set to challenge OPEC and Russia’s ability to maintain price stability.”

Leave A Comment