Overheard in Washington today…

Video length: 00:00:18

Equities slipped, the dollar gained and the Treasury yield curve flattened further as markets reacted to the suggestion that Senate tax writers will release a bill Thursday, according to Senate Finance Chairman Orrin Hatch.

Stock indexes across the Gulf were among the world’s worst performers, with Saudi Arabia’s Tadawul All Share Index falling the most in a year before paring losses.

Since the Saudi shenanigans, bonds and bullion are outperforming…

Trannies and Small Caps are notably weak as Dow, S&P, and Nasdaq cling to unch on the week… (Small Caps worst day in 3 months)

The Dow was desperately pumped back to green by the close… another new record high…

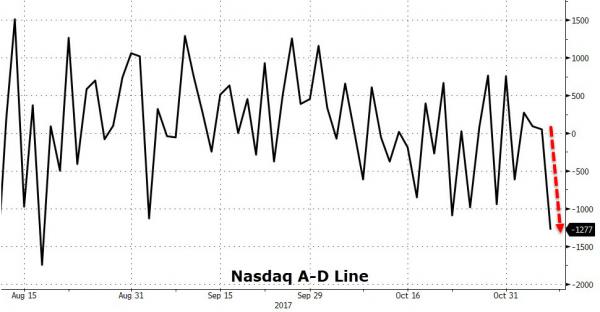

It was also a very weak breadth day…

Blue Apron was very red…

And Red Robin shareholders were blue…

Tax reform hopes faded notably today…

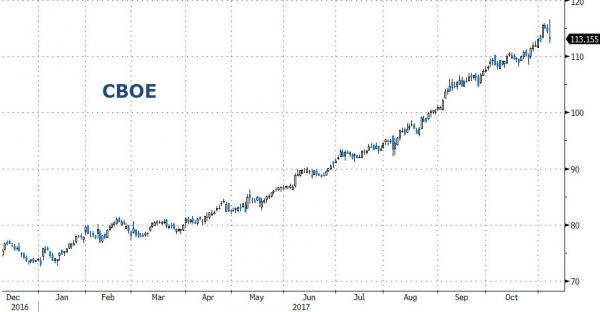

We also wanted to noted this chart – have you ever seen a chart so placidly plodding higher without a heart beat?

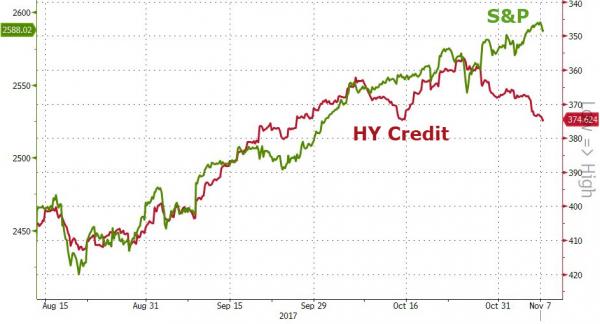

High yield credit markets continue to signal trouble…

And as the cost of protecting credit has recently surged, so the cost of protecting stocks has decoupled from the underlying…

Equity vol has been languishing for months but the last week or so has seen FX and Rates volatility collapse… (FX Vol now at 3-year lows and Rate vol at record lows)

High yield bond prices (HYG) are the furthest below the 200DMA since the election…

Treasury yields were mixed with the long-end lower in yield and short-end unch…

Leave A Comment