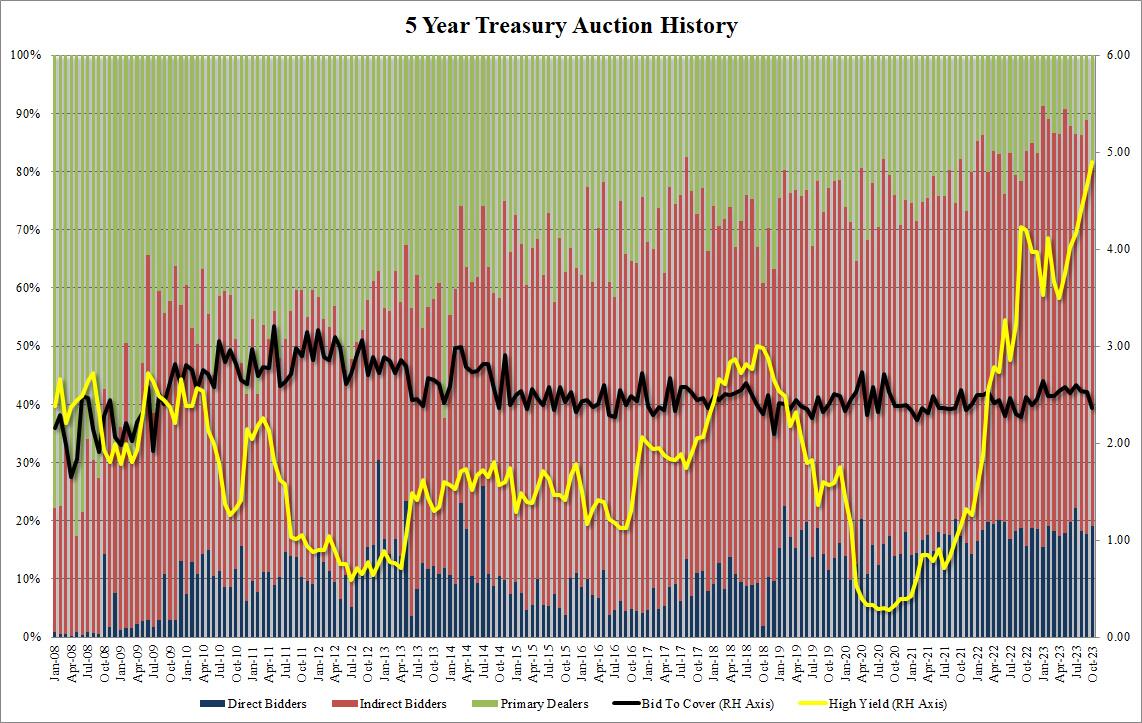

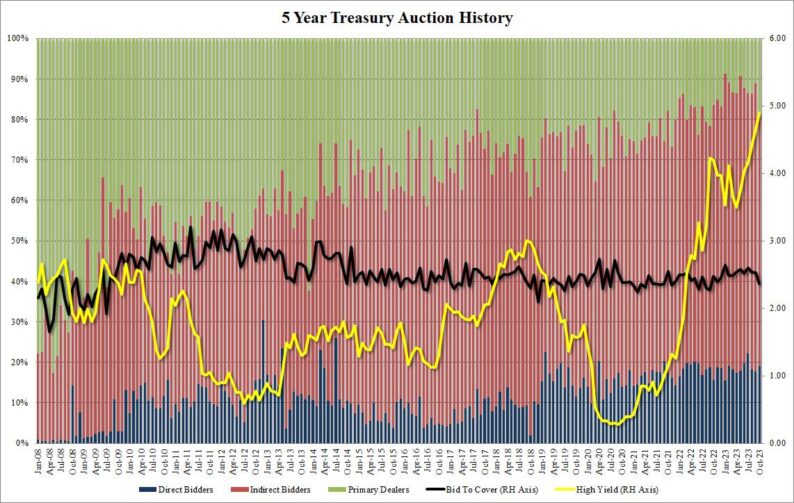

Well, the treasury market respite from the “Bills” closing out their shorts was, as expected, quite short lived and moments ago the pricing of an ugly 5Y auction reminded just how much more pain lies in store for the US bond market.The sale of $52BN in 5Y notes priced at a high yield of 4.899%, more than 20bps above last month’s 4.671%, the highest yield since June 2007, and also tailing the 4.880% When Issued by a whopping 1.9bps, which was the biggest tail since last September and the 4th biggest tail in the past decade.The bid to cover of 2.36 was also rather ugly, and not only was it below last month’s 2.52 and the six-auction average of 2.55, it was (also) the worst since last September.The internals were even uglier with Indirects sliding by almost 10bps to 61.5% from 71.2%, the lowest since – you guessed it – last September, and below the recent average of 68.9%. And with Directs awarded 19.1%, or roughly in line with the recent average, Dealers were left holding 19.4%, the most since, drumroll, last September.

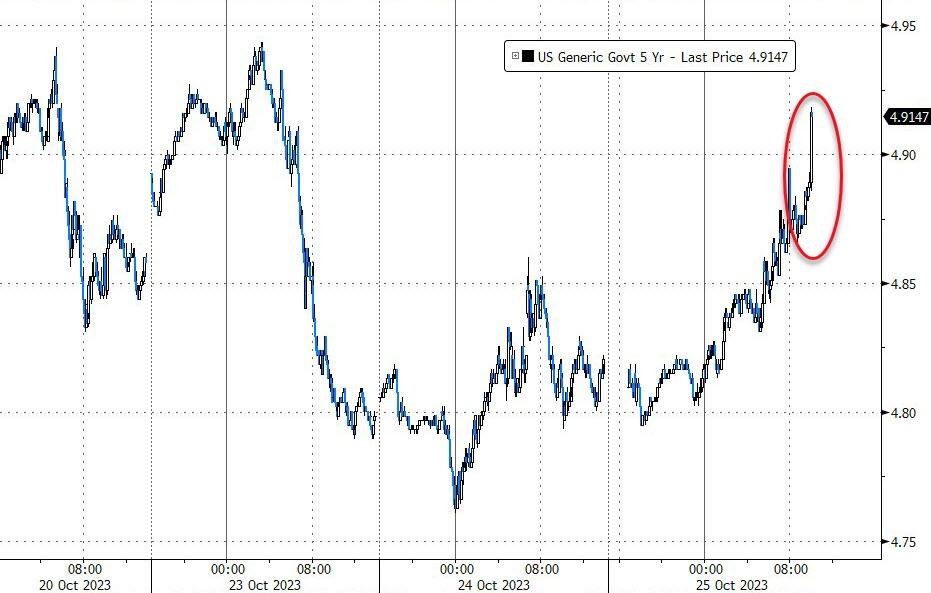

The auction was so ugly, the bond market was rocked wider with the 10Y rising as high as 4.95%, and fast approaching the key level of 5.00% where yields halted their retreat earlier this week.  More By This Author:IRS Collects $160 Million From Wealthy Taxpayers Amid ‘Increased Compliance Efforts’Regional Fed Surveys Show Prices Jumping As Business Outlooks SlumpChina Kicks Fiscal Stimulus Into Overdrive With Deficit-Busting 1 Trillion Yuan In New Debt

More By This Author:IRS Collects $160 Million From Wealthy Taxpayers Amid ‘Increased Compliance Efforts’Regional Fed Surveys Show Prices Jumping As Business Outlooks SlumpChina Kicks Fiscal Stimulus Into Overdrive With Deficit-Busting 1 Trillion Yuan In New Debt

Leave A Comment