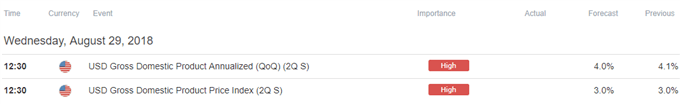

Updates to the 2Q U.S. Gross Domestic Product (GDP) report may produce headwinds for the dollar as the growth rate is now expected to increase 4.0% versus an initial forecast for a 4.1% print.

A marked downward revision in the GDP figure may impact the monetary policy outlook as signs of a less robust economy rattles bets for an extended hiking-cycle, and Chairman Jerome Powell & Co. may continue to project a neutral Fed Funds rate of 2.75% to 3.00% as measures for inflation show ‘no clear sign of an acceleration above 2 percent.’

With that said, the Federal Open Market Committee (FOMC) may deliver a dovish rate-hike at the next quarterly meeting in September, but a positive development may keep the Fed on track to implement four rate-hikes in 2018 as the central bank largely achieves its dual mandate for full-employment and price stability.

IMPACT THAT THE U.S. GDP REPORT HAS HAD ON EUR/USD DURING THE PREVIOUS QUARTER

Period

Data Released

Estimate

Actual

Pips Change

(1 Hour post event )

Pips Change

(End of Day post event)

1Q P

2018

05/30/2018 12:30:00 GMT

2.3%

2.2%

-7

+29

Preliminary 1Q 2018 U.S. Gross Domestic Product (GDP)

EUR/USD 10-Minute Chart

Adjustments to the 1Q U.S. Gross Domestic Product (GDP) report showed the economy growing 2.2% versus an initial forecast of 2.3%, with the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, highlighting similar dynamic as the index narrowed to 2.3% from 2.5%. The measure for Personal Consumption also failed to meet market expectations as the figure printed at 1.0% amid projections for a 1.2% clip.

Nevertheless, the revisions sparked a limited reaction in EUR/USD, with the exchange rate appreciating during the North American trade to close the day at 1.1661.

Leave A Comment