USD/CHF in consolidation below yearly highs- updated breakout targets

The Swiss Franc has been in consolidation for the past few months with USD/CHF trading just below key resistance at the yearly highs. Here are the updated targets and invalidation levels that matter on the USD/CHF charts heading into the close of the week.

USD/CHF DAILY PRICE CHART

Technical Outlook:

USD/CHF has continued to trade within the confines of the initial August opening range. Key confluence support rests at 9890-9902 where the monthly open converges on the 61.8% retracement of the June advance, the 100 day moving average and basic trendline support. Daily resistance stands at 9991– a breach above this region would be needed to validate a near-term breakout targeting key resistance at 1.0058/71 (breach / close above to mark resumption).

USD/CHF 240MIN PRICE CHART

Notes: A closer look at USD/CHF price action further highlights this near-term price consolidation with the pair still holding within the weekly opening range. Until we break this range, treat it as such. A downside break would expose 9846/50 backed by the June lows at 9788.

Bottom line:

USD/CHF remains within a well-defined range and we’re looking for a break of monthly opening-range (9890-9991) to offer further guidance on our near-term directional bias. From a trading standpoint, I’ve favored fading strength while within this zone until we get the definitive break.

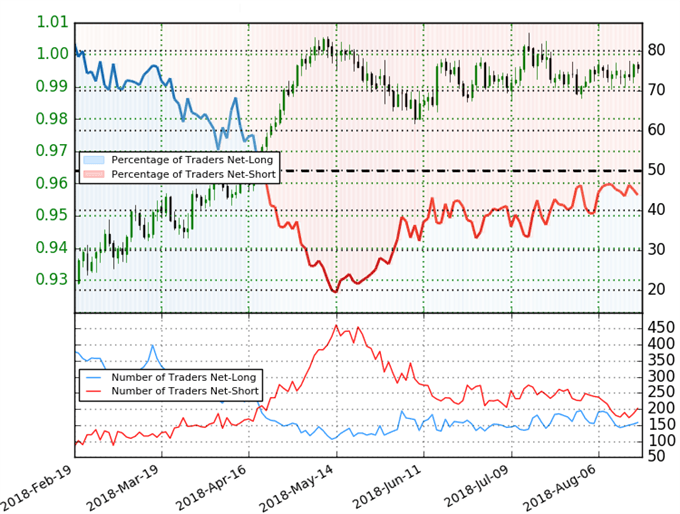

USD/CHF TRADER SENTIMENT

Leave A Comment