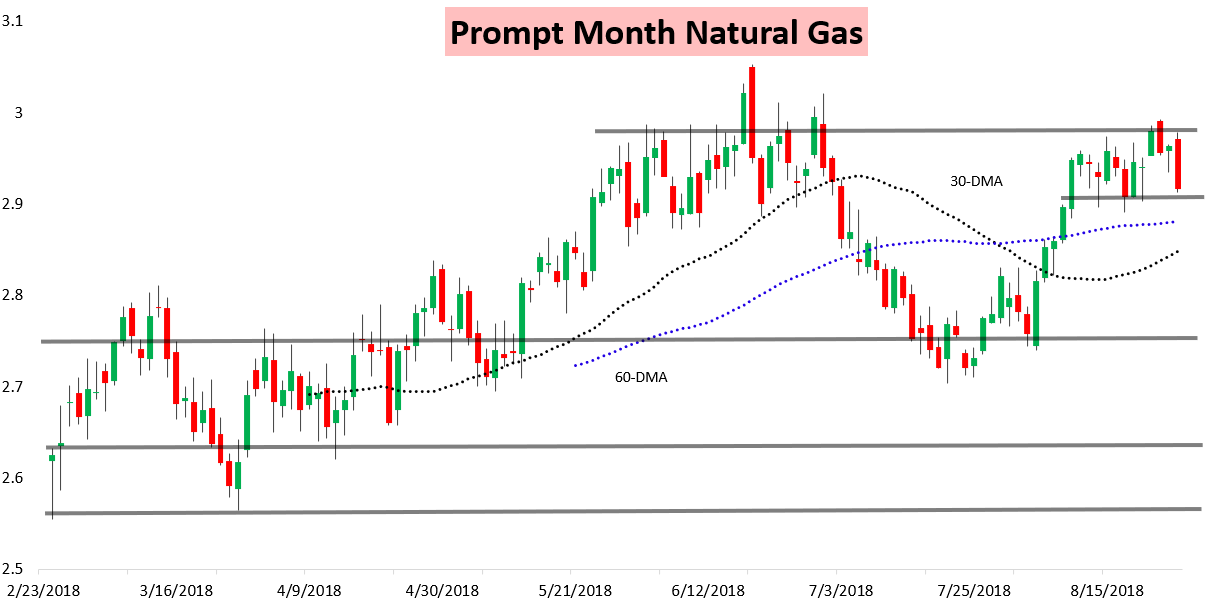

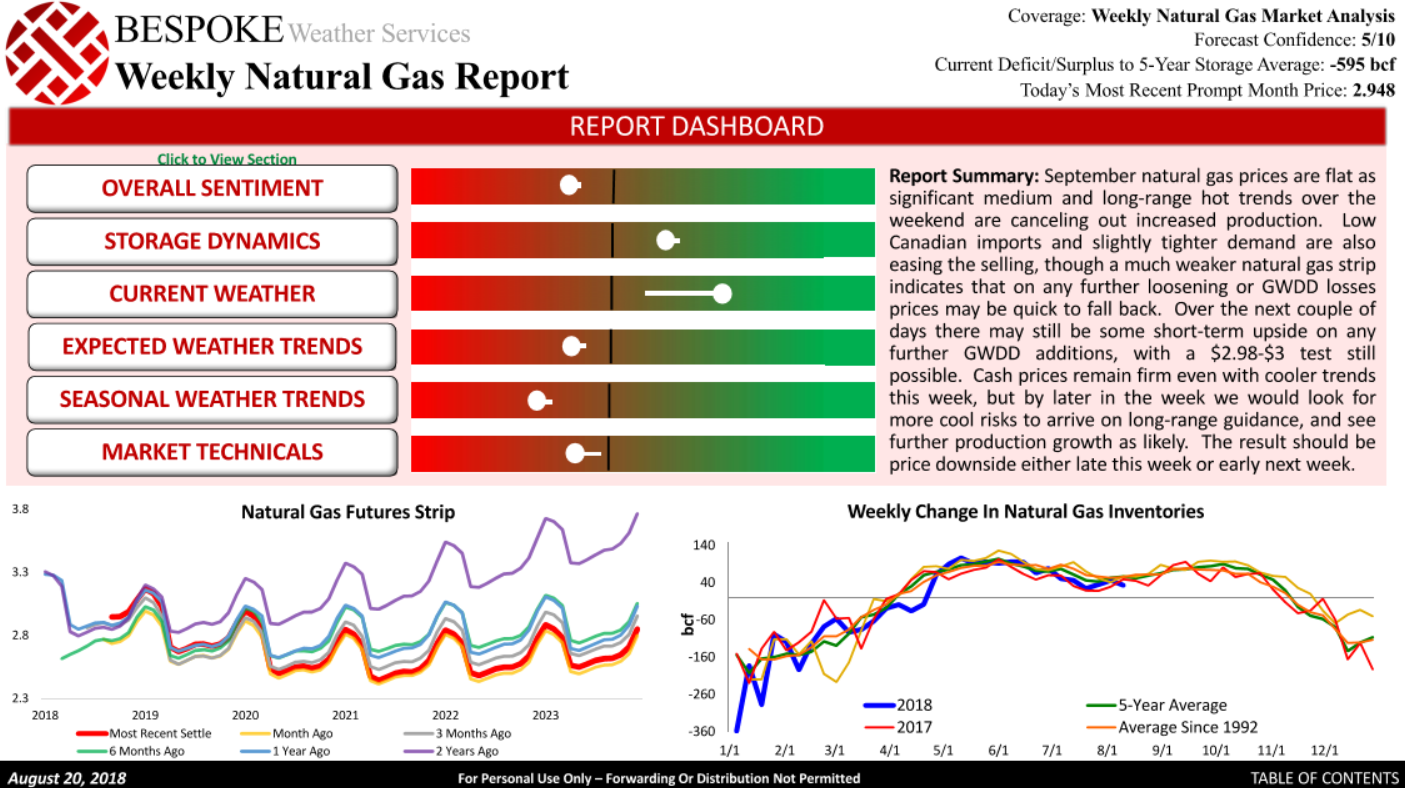

The September natural gas contract sold off around a percent and a half on the day, moving to the lower end of the recent range ahead of the weekend.

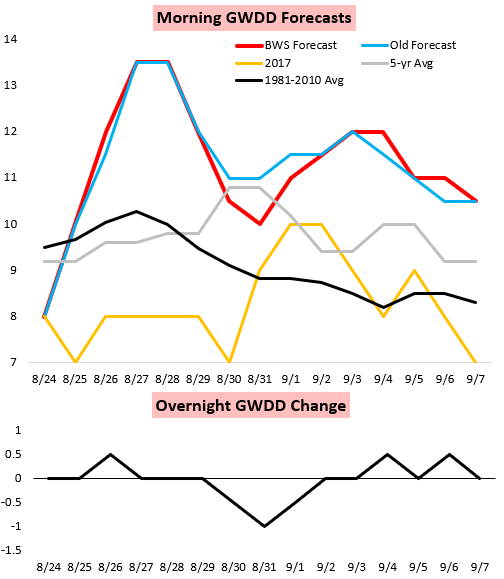

Generally, trading this week fit right into our expectations from Monday, as we looked for short-term cash strength to push prices into resistance from $2.98-$3, but saw resistance holding and downside pressure building later in the week as balances would loosen and forecasts would cool.

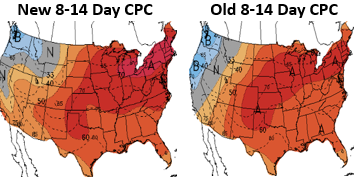

Long-range forecasts from Monday did cool through the week as we see a period of cooler weather likely to close out August, as seen in our Morning Update this morning.

However, heat remains central to forecasts as well, with afternoon Climate Prediction Center forecasts calling for high confidence heat throughout the 8-14 Day period.

Yet this heat was certainly not enough to save natural gas prices today, with the entire strip moving solidly lower on the day (and the week).

Every day in our Note of the Day we publish our Daily Natural Gas Balance View where we look at weather-adjusted power burns and demand as well as LNG Exports and estimated dry production. Through the week we had cautioned that the market was looking rather loose and that opened up downside risk. We accordingly expected the market to set a short-term top soon in our Wednesday Note of the Day.

Granted, such loosening is necessary when storage levels are sitting outside the 5-year range and so far below the 5-year average.

Leave A Comment