These are difficult times for value investors. Stock prices keep rising as profits stagnate. Overvalued stocks such as Netflix (NFLX: $147/share) continue to make new highs. Even legendary value investor Jeremy Grantham seems to have thrown in the towel. Earlier this month, Goldman Sachs issued a report titled “The Death of Value.”

Our message to value investors: don’t despair. Value investing isn’t dead—but it has gotten harder. In order to find value, investors need to look beyond the widely-available and misleading accounting results on which most people focus. It’s time to get back to the basics of reading footnotes and focusing on economic earnings and return on invested capital (ROIC), the true drivers of valuation.

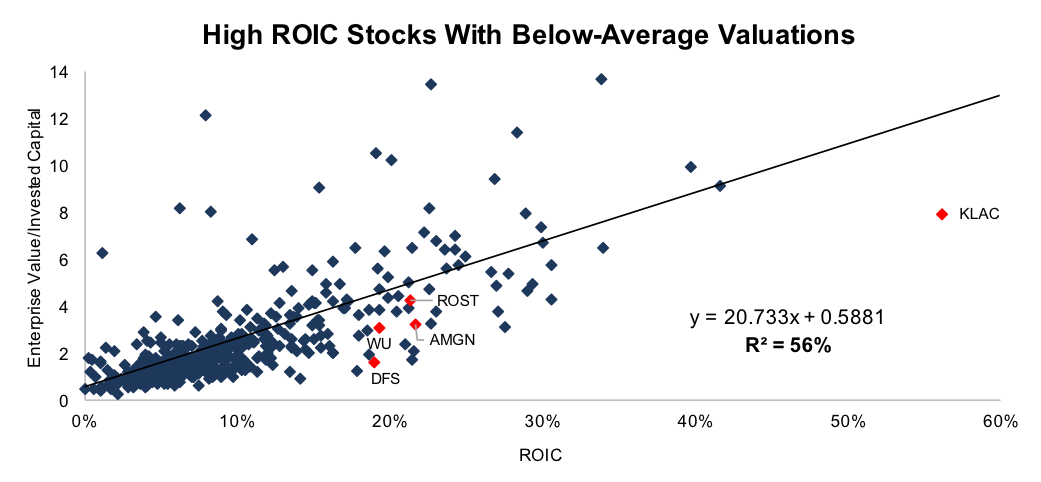

Figure 1 shows that changes in ROIC explain 56% of the difference in enterprise value per invested capital (a cleaner version of price-to-book) for the S&P 500. It also identifies five stocks with high ROIC’s trading well below their implied valuation.

Figure 1: ROIC Vs. Valuation For The S&P 500

Sources: New Constructs, LLC and company filings.

These five stocks are not only undervalued according to this regression analysis, they also share a couple other positive traits:

Investors looking for value in this overextended market should start with these stocks.

KLA-Tencor (KLAC: $93/share)

KLA-Tencor is the largest player in the semiconductor process control segment, owning over 50% of the market. This dominant share has allowed the company to earn impressive margins and grow its ROIC from 29% in 2013 to its current level of 56%.

If KLAC was valued at the level implied by the trend line in Figure 1, it would be worth ~$148/share today, 59% above its current valuation. KLAC’s current price implies that its ROIC will permanently decline to 36%.

Leave A Comment