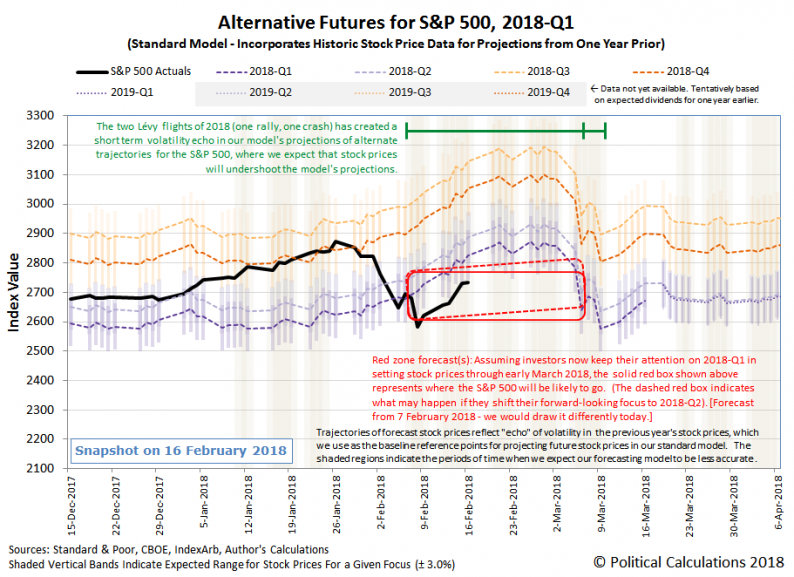

After the wild ride it went on in the first full week of February 2018, the S&P 500 (Index: SPX) rallied in a subdued fashion during the second week of February 2018.

The subdued rebound for the S&P 500 was all the more remarkable because it occurred in an news environment where a resurgence in consumer inflation became more of a concern for markets, to the point where speculation began to rise that the Fed might hike short term interest rates in the U.S. four times in 2018.

Checking in with the CME Group’s Fedwatch tool, we find that investors are still only betting on three rate hikes occurring during 2018, near the end of the current quarter of 2018-Q1, and the more distant future quarters of 2018-Q2 and 2018-Q4, where the probabilities reported by the tool indicate a greater-than-50% chance that the Federal Funds Rate will be increased by a quarter point (or more) at these specific points of time in the future.

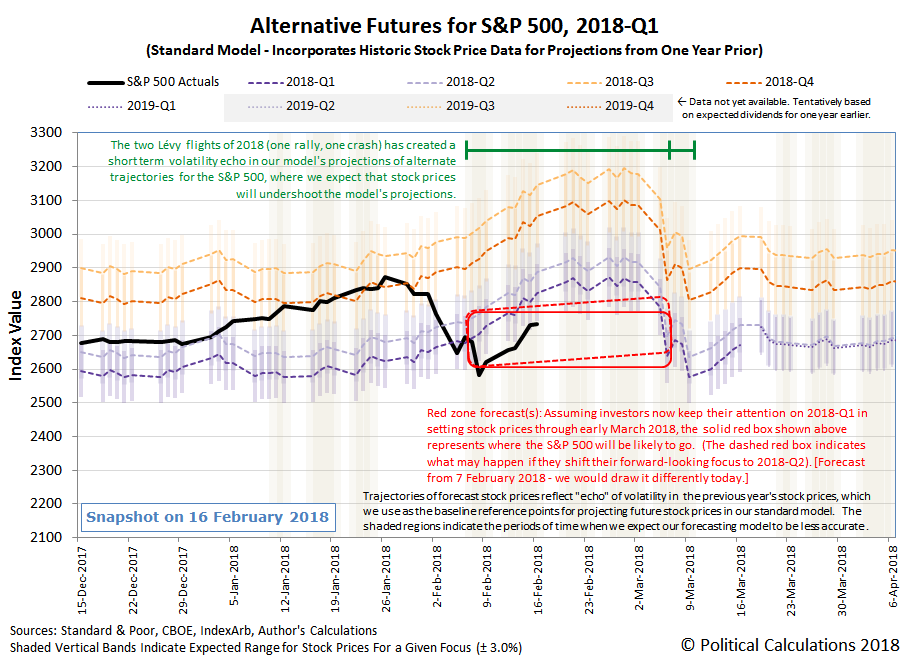

The headline of the week was the drastic reduction in the kind of volatility that characterized the previous two weeks for the S&P 500. So much so that if we were to redraw our “connect-the-dots” manual forecasts of the potential trajectory of stock prices in our alternative trajectories chart above, we would choose a projected point for the alternative trajectories of 2018-Q1 and 2018-Q2 in the second week of March 2018, which would fall outside of the short term volatility echo in our model’s projections, where they would extend slightly longer and instead of being flat-to-slowly rising, they would indicate slowing declining-to-flat.

Leave A Comment