It was an ugly sell off, but Tuesday’s lows weren’t challenged and this will stand in bulls favor tomorrow. However, the day itself was clearly one where bears had control from the open through to the close. There is still the need to break the consolidation, and bulls will look to contain further losses tomorrow.

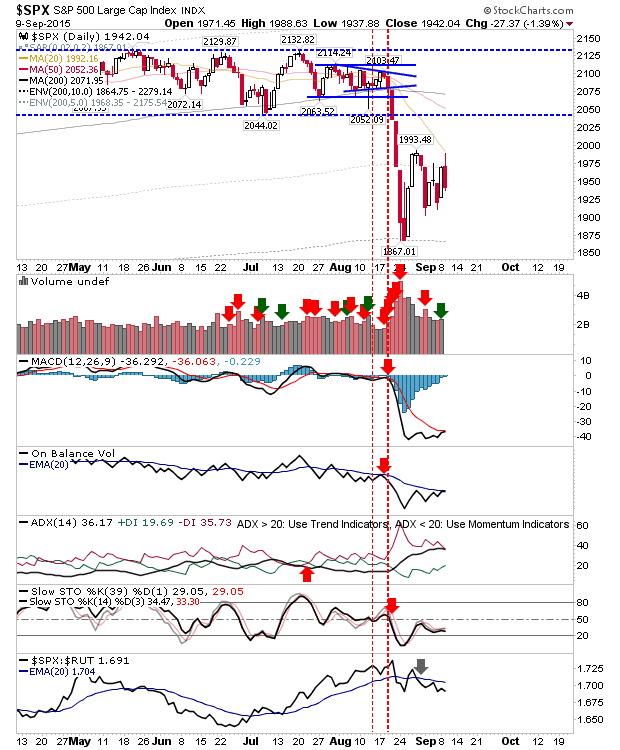

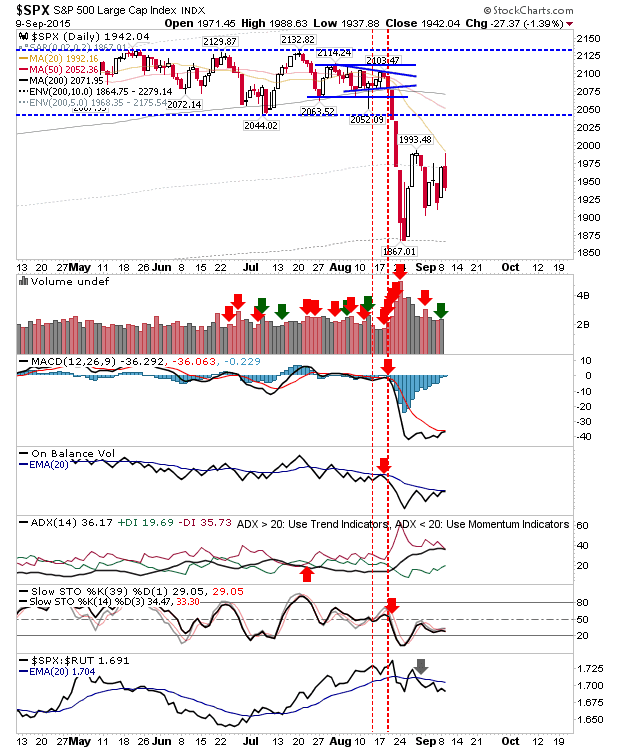

The S&P is on the verge of a MACD trigger ‘buy’ and On-Balance-Volume ‘buy’. However, it’s still clearly underperforming against the Russell 2000.

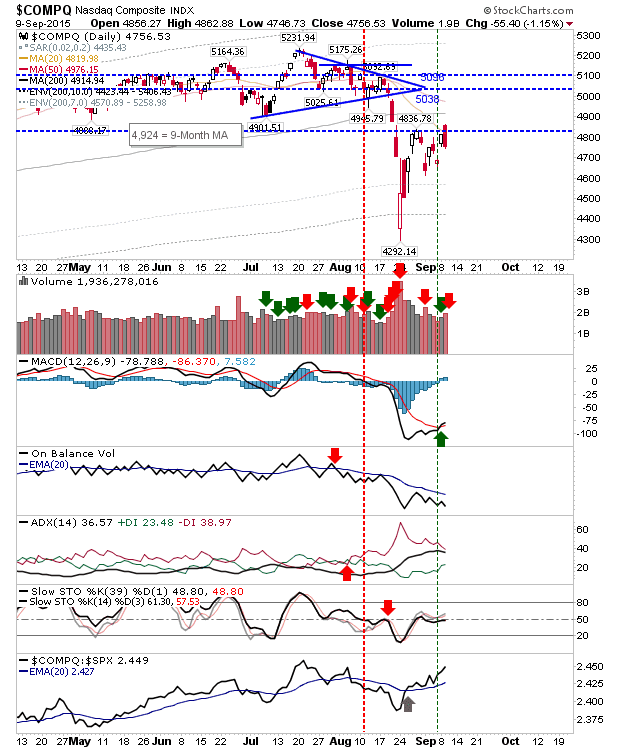

The Nasdaq finished with a bearish engulfing pattern which sets up for lower prices tomorrow. It has got a MACD trigger ‘buy’ in play, albeit a weak one, which is unlikely to last in the face of today’s price action.

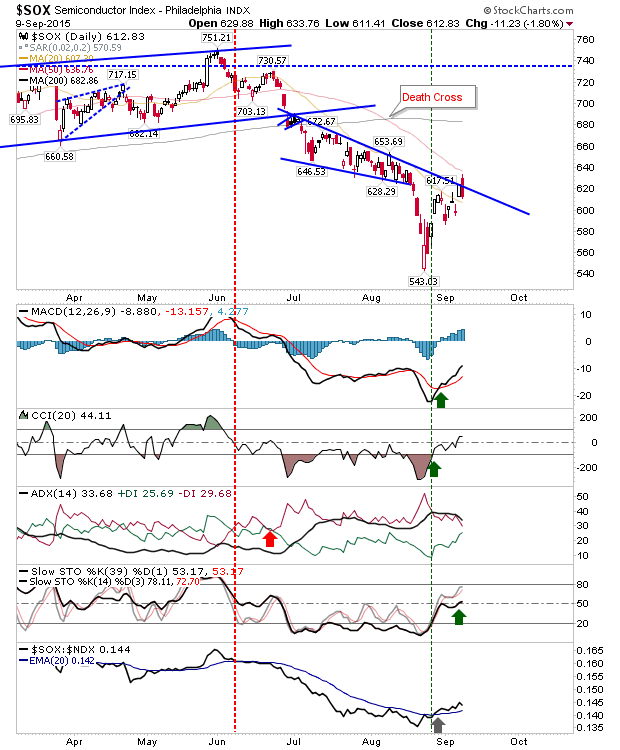

The Semiconductor Index also reversed from resistance. Weakness here will fuel more losses for the Nasdaq and Nasdaq 100.

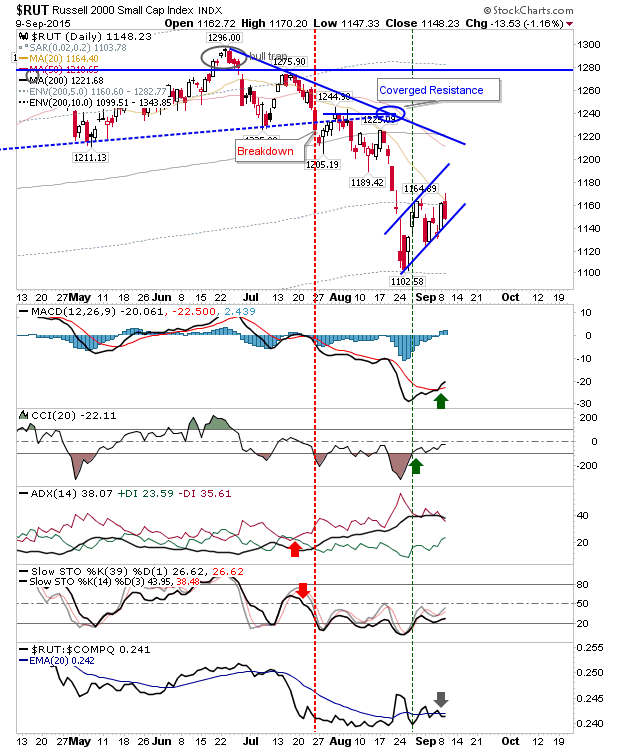

The Russell 2000 was pegged by its 20-day MA in what looks to be a ‘bear flag’. Technicals are looking a little more bullish with established ‘buy’ signals in CCI and MACD. Again, the ‘buy’ in the MACD and CCI are weak signals.

For tomorrow, watch for follow through downside across all indices. Bulls will look to step in at yesterday’s lows, but if selling momentum is high they may be reluctant to go in with both feet. Today’s action suggests Thursday will be another one for sellers.

Leave A Comment