EU Session Bullet Report – USD retreats after ISM data

US dollar is on the backbeat today, continuing from yesterday’s mild selloff as US manufacturing data raised questions about how aggressive the FED would be when hiking interest rates. US ISM contracted to the weakest level since 2009, and it could prevent the FED from actively hiking rates (later on) as it showed that monetary tightening could negatively affect the US economy through a stronger USD. Investors focus now turns to the ECB tomorrow and NFP on Friday, as NFP is a factor that could determine what kind of a rate hike path we will have in 2016.

AUDUSD, already bullish from yesterday, reached highs of 0.7354 after the RBA skipped the chance to cut rates on Tuesday. Overall USD index, retreated from the 8.5 month high at 100.31 on Monday and stood at 99.938 after the ISM figures. As a result GOLD and other commodities found a chance to rebound, albeit softly, reaching 1074.50 highs.

Data wise we have UK construction PMI, then US ADP employment report, Canadian interest rate decision and the Fed’s beige book.

Trading quote of the day:

“No profession requires more hard work, intelligence, patience, and mental discipline than successful speculation.” – Robert Rhea

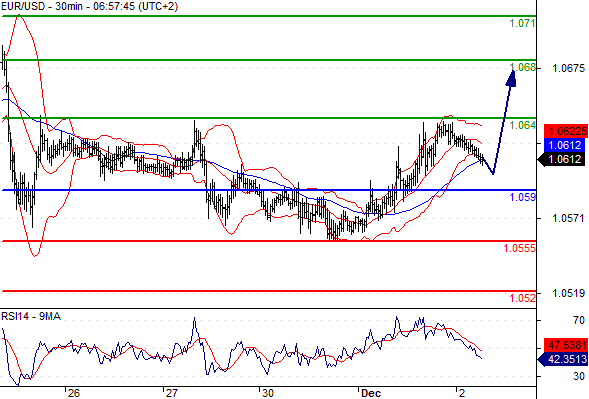

Green lines are resistance, Red lines are support.

EUR/USD

Pivot: 1.059

Likely scenario: Long positions above 1.059 with targets @ 1.064 & 1.068 in extension.

Alternative scenario: Below 1.059 look for further downside with 1.0555 & 1.052 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

GBP/USD

Pivot: 1.5045

Likely scenario: Long positions above 1.5045 with targets @ 1.5095 & 1.5125 in extension.

Alternative scenario: Below 1.5045 look for further downside with 1.501 & 1.499 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Leave A Comment