What You Need To Understand:

The stakes are high, yet the explicit implications are hazy. The United Kingdom will vote on whether or not to remain a member of the European Union. The outcome will determine not only whether the United Kingdom stays with the EU, but could also impact credit ratings, reserve currency status, and perhaps the economic future the United Kingdom.

Because markets trade on anticipation of future outcomes, the volatility will likely be greater leading up to the event than days after the outcome is known. You should know the potential market ramifications of staying and leaving for the British economy and currency, the Pound. Moreover, it is important to understand how certain outcomes affect the EuroZone as a whole.

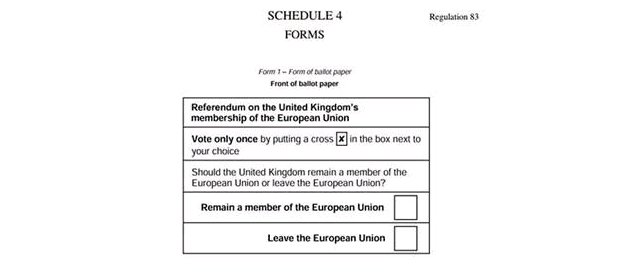

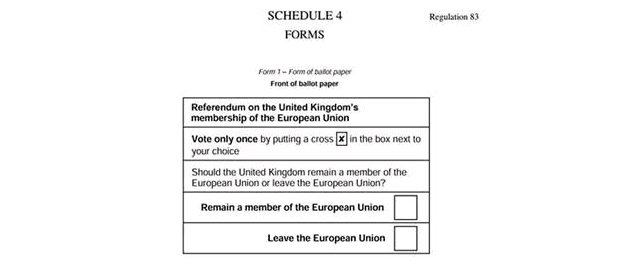

When Is the Vote?

On June 23, the UK electorate will be looking at the following ballot paper in the United Kingdom

Who & What to Watch: Cable, Credit, & Cameron

David Cameron, the Prime Minister of the United Kingdom,is front and center for the ‘Brexit’vote as well asthe negotiations should Britain remain in the EU. The bimodal campaigns of ‘stay’ or ‘leave’are effectivelyvoting on trade, EU budget, regulation, immigration (which has become a huge sticking point due to the Syrian war displacement), and EU influence over Britain’s economy going forward.

The genesis of the Brexit vote was part of PM David Cameron’s 2015 reelection campaign, where he announced in 2013 as a strategy to strengthen the relationship between Britain and Europe in hopes to make a good relationship better. However, the negotiation might end up being the undoing for now of the conservative party if the rising UK Independence Party (or UKIP) gets their preferred outcome.

David Cameron will look to impress the possible negative economic implications and general shock that could arise from an exit vote. Therefore, as new polling results come in it will be important to watch how Sterling trades, and how credit is priced to reflect the perceived risk of repayment in the market. At the end of February, large banks such as JP Morgan, Goldman Sachs, and HSBC, who have large exposure to creditand ongoing operations in Britain have sided with David Cameron in saying the benefits of staying in the EU outweigh those of the opposite camp.

What’s on the Table?

The attention is currently centered on the implications for the United Kingdom. However, you should not dismiss the negative implications to the European Union losing one of its wealthiest members, which could provide a further argument for the exit of other large countries perhaps even core members and/ orEurozone participants such as Italy.

The United Kingdom’s ability to leave has already stoked a sense of unfairness in the 28 EU nation agreement. French President Francois Hollande & Maltese Prime Minister Joseph Muscat were quick to demand their countries be afforded similar benefits that the United Kingdom seeks to enjoy. The rift is not ill-founded. In 2011, an agreement for Britain to take EU initiatives to a referendum passed displaying an unmistakable two-tier system with Britain receiving special considerations that weigh on the fairness of the European Union economic agreement.

Therefore, even if Britain decides to “remain a member” of the EU, the rising threat of another exit will likely have ripple effects for years to come. One thing that Britain will try to avoid should a Brexit be cast is not todisrupt the relationships with the majority of their trading partners still within the EU. Currently, seven of the UK’s nine largest trade partners are EU members, and the risk of damaged trade relationships with even one of those would be great.

Leave A Comment