The Dividend Aristocrats are among the best dividend growth stocks in the entire stock market. Dividend Aristocrats are stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases. There are just 53 Dividend Aristocrats. You can see all 53 Dividend Aristocrats here.

Cardinal Health (CAH) is a Dividend Aristocrat, and has increased its dividend for 32 years in a row, including a 3% hike on May 3rd 2017. Over the past few years, Cardinal Health has struggled with deflation and rising competition in its core business of pharmaceutical distribution. At the same time, the company has a leading position in the industry, and has a long track record of dividend growth.

While it has encountered significant operating challenges recently, the company is building a successful turnaround. Its most recent quarterly earnings report, released on February 8th, provided even more evidence that the turnaround is working.

This article will review Cardinal’s strong earnings report, and discuss why the stock is still attractive for value and dividend growth investors.

Earnings Overview

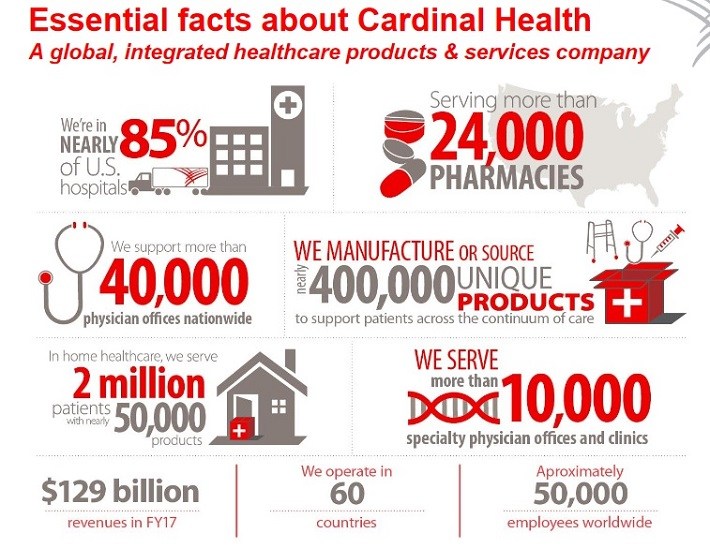

Cardinal Health is a giant in the healthcare supply industry. It operates in 60 countries, and generates annual revenue of approximately $129 billion.

Source: 2017 Annual Stockholder Meeting, page 5

The company has two operating segments, Pharmaceutical and Medical product distribution. Pharmaceutical products comprise roughly 90% of Cardinal Health’s total revenue.

For the fiscal 2018 second quarter, Cardinal Health reported adjusted earnings-per-share of $1.51, which included a $0.20 per-share benefit from tax reform. Excluding the tax-related boost, adjusted earnings-per-share were $1.31, on revenue of $35.19 billion.

Both figures significantly beat analyst estimates. Earnings-per-share and revenue beat expectations by $0.16 and $540 million, respectively, which indicates a strong beat on both the top and bottom line.

Leave A Comment