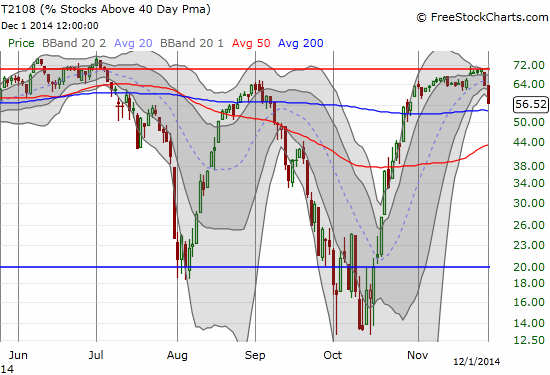

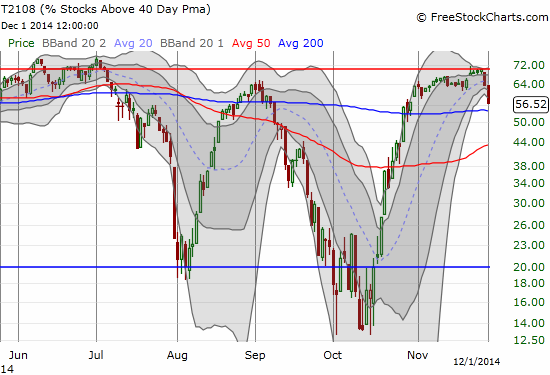

T2108 Status: 56.5% (2-day decline of 20% qualifies for quasi-oversold status)

T2107 Status: 49.4%

VIX Status: 14.3

General (Short-term) Trading Call: Hold bullish positions but start taking profits if S&P 500 selling follows through. Aggressive bears can start shorting with stops at new all-time highs

Active T2108 periods: Day #30 over 20%, Day #28 over 30%, Day #25 over 40%, Day #23 over 50%, Day #1 under 60% (the underperiod ends 17 days over 60%), Day #100 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

My favorite technical indicator, T2108, never did quite hit overbought status, but I declared it “close enough.” On “Black Friday”, T2108 beat a definitive retreat from the overbought threshold to flash a bearish signal even clearer than September’s retreat. Today’s downward extension for T2108 confirms a bearish topping pattern even as the 20% 2-day decline creates a quasi-oversold condition. The T2108 Trading Model (TTM) produces 62% odds of another drop on Tuesday. However, the classification error is 51% which renders the prediction effectively useless. I am not surprised since the model is much better at projecting upside than downside, especially from lofty levels like these.

T2108 turns sharply downward in a clear topping signal even with quasi-oversold conditions triggered

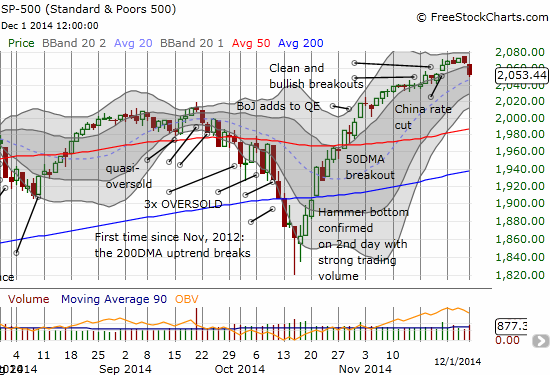

The S&P 500 (SPY) declined 0.68%. It was a fractional loss, but the selling volume pushed the index into a close of the gap created by the surprise rate cut from China on November 21, 2014.

The S&P 500 retreat has now closed the gap up inspired by the surprised Chinese rate cut on November 21, 2014

According to the overbought trading rules I set out, I still need follow-through selling from here to confirm the end of the gap up before I can get fully bearish. Even with such confirmation, I will be VERY reluctant to get aggressively bearish. I WILL reluctantly retreat on my very bullish plan to hold my ProShares Ultra S&P500 (SSO) shares into next Spring. They were hard-earned after two purchases during October’s oversold periods; I like to consider them on-going reminders of the power and potential of the T2108 trading methodology.

Leave A Comment