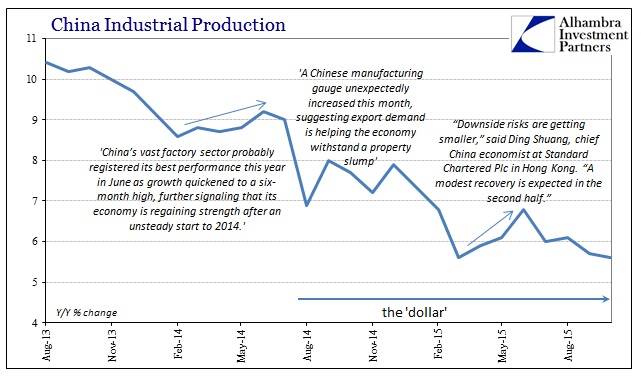

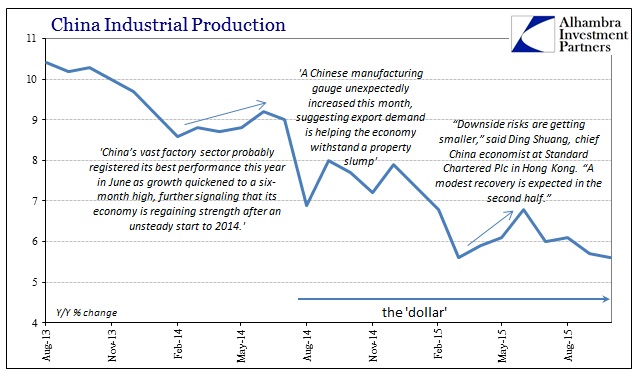

Once more we find no end in sight to the Chinese slowdown. To complete the weekly sweep of highly negative Chinese accounts, the major three released today were unfortunately complimentary to those already publicized. Only retail sales accelerated and by the smallest increment; in context, however, at 11% retail sales are still lower than the worst month of the China’s end of the Great Recession. Industrial production fell back to 5.6%, matching March (no more “transitory”) for the worst growth rate of this “cycle.” Perhaps most meaningfully, fixed asset investment (which is presented as an accumulated YTD growth rate, leaving indirect inference for individual months as they come out) was only 10.2% and the lowest levels since December 2000.

Private FAI, a relatively new addition from the National Bureau of Statistics China, was only 10.4% in September, having been 18.1% at the end of 2014 and 23.1% at the end of 2013. By all counts, the economic climate in China in 2015 is substantially worse than the rather steady slowing that has been at work since 2012. Despite the obviousness of that baseline, each positive monthly variation has been taken as if “stimulus” was working, only to be dependably tossed aside as long-forgotten, inappropriate memories. It is, instead, becoming increasingly clear the PBOC has no real power or effort by which to arrest the trend should it actually attempt to.

By far, the worst element of China’s recent experience is the torture of extension. In other words, quite unlike even the worst of the Great Recession, this slowing is unending; grinding lower month after month after month (seeing past, of course, those monthly variations). It is almost too unrealistic to contemplate, but industrial production had been 8% or below in China for only three months during the Great Recession; it has been 8% or below in every month dating back to last July, for a total of 15 months and counting. That turn, while still conforming to the 2012 trend, represented a new amplification that dates exactly to when the “dollar” found new “tightening.”

Leave A Comment