The DAX 30 is up by 1.93% at the time of writing on a sturdier global risk-appetite. However, today’s soft German PMI may change this.

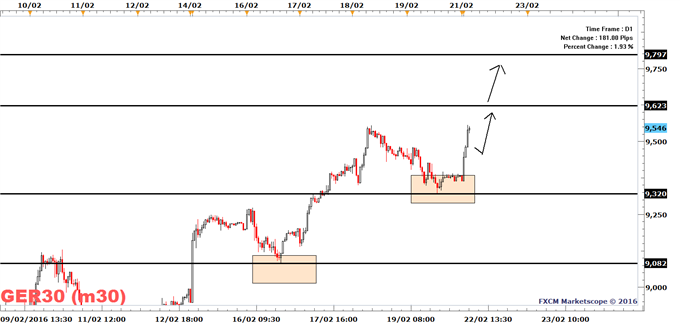

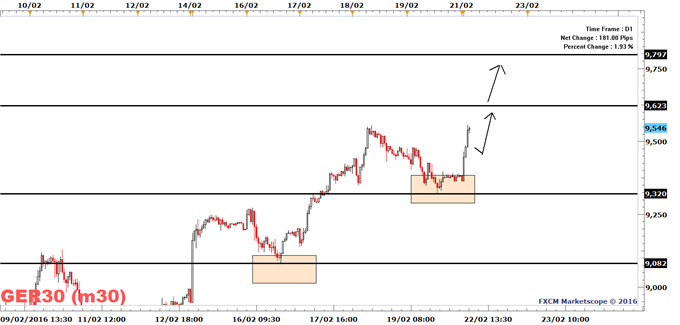

Short-Term Bullish Above 9320

Friday’s low of 9320 is the short-term trend defining low, and as long as price trades above this level, the DAX 30 may reach the February 4 high of 9623. On a break to this high the index may reach the February 1 high of 9797.

Traders not long will probably use a pullback to the 9470-9400 range to enter in line with the trend, as therisk/reward ratio for bullish positions is slightly better here than current levels (9546).

Up on U.S. data and Down on German?

The latest rally across global stock markets is fueled by better than expected U.S. data and the Atlanta Fed GDPNow model now projects a 2.6% rise in U.S. first quarter GDP. However, German and European data has turned sour.

From beating the consensus since August 2015, European data is now underperforming from the end of January, and the leading indicators are not looking pretty.

German Manufacturing Sector To Contract?

German Manufacturing PMI slipped to 50.2 from 52.3 in January, with a reading below 50 suggesting that the manufacturing sector is contracting. This is something which may become a reality over the coming months due to the slowdown in ‘new orders’. French figures are even gloomier, with PMI Manufacturingsliding to 49.8 from 50.2.

For now the German DAX 30 is ignoring these reports, but they may well return to haunt it.

The day continues with more PMI releases on tap and this afternoon Chicago PMI is expected to improve from -0.22 to -0.10, while Markit U.S. PMI is expected to improve from 52.4 to 52.5.

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

Leave A Comment