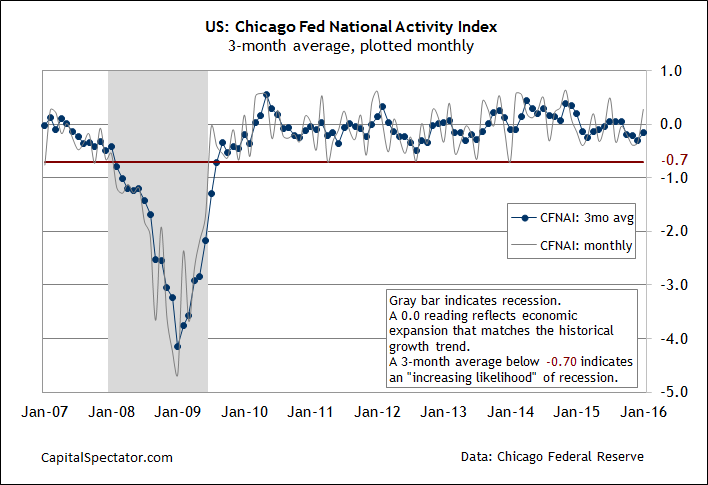

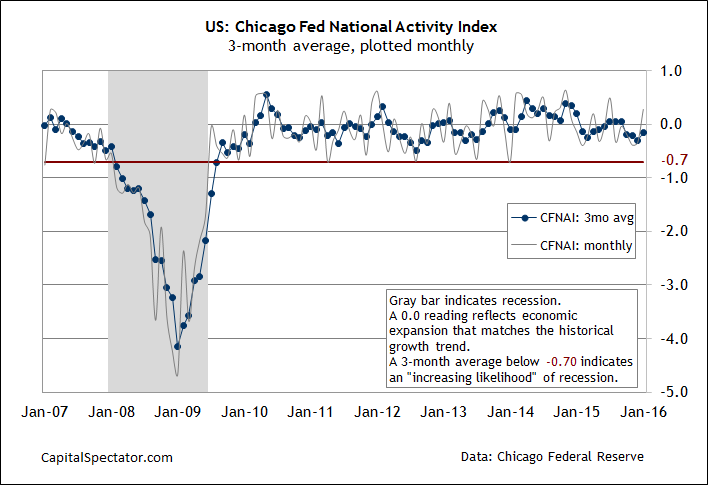

US economic output in January posted a modestly stronger trend vs. the previous month, according to this morning’s update of the Chicago Fed National Activity Index. This macro benchmark’s three-month average (CFNAI-MA3) rose to -0.15 last month, matching The Capital Spectator’s projection that was posted on Friday.

Today’s update deals another blow to the implied recession warning that’s been bubbling in financial markets in recent weeks. Last week’s monthly US macro profile dispensed a similar message of modestly stronger growth, which suggests that the NBER is unlikely to declare the first month of this year as the start of a new recession.

CFNAI-MA3’s current print puts the index well above the -0.70 tipping point that marks the start of new recessions, based on Chicago Fed guidelines. In fact, the latest rise marks a four-month high for CFNAI-MA3, which reflects a broad sweep of 85 indicators. Nonetheless, the modestly negative value continues to indicate a below-trend pace of growth for the fourth straight month.

“January’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend,” the Chicago Fed said in a press release today. “The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.”

Note that the monthly value for the index posted a stronger rebound, rising well into positive territory. The +0.28 value for the January level of CFNAI indicates the highest reading for a single month since last July. For the moment, at least, there’s a bit more evidence for arguing that Mr. Market’s dark expectations for the economy this year have been excessive.

As yesterday’s edition of the US Business Cycle Risk Report advised, the case for “cautious optimism rolls on. A markets-based reading of the macro trend is still issuing a warning, but there’s enough forward momentum in the formal economic indicators to reserve judgment.” Today’s report from the Chicago Fed certainly strengthens that view.

Leave A Comment