Juniper Networks (JNPR) proves that not all tech companies receive love. It’s a $10B company involved in enterprise networking and IT solutions. Selling, installing, managing and optimizing networks means they compete with names like Cisco (CSCO), HP (HPE) and F5 Networks (FFIV).

But Juniper is the topic of the day as it shows up in my Sleeper Stock screen.

What are Sleeper Stocks?

It’s a name I give to find stocks offering Quality + Value. It’s two out of the three core criteria I look for. The three main categories are Quality, Value and Growth.

As the universe of stocks is quite small at the center, I don’t mind venturing out to to find new ideas.

In the image above, Juniper falls in the purple shade between Quality and Value, and the numbers that point to this particular section are as follows:

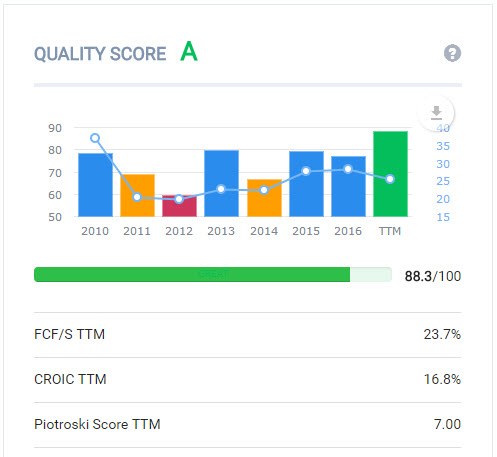

Juniper Quality Score Factors

Source: Old School Value Quality Score

FCF/S shows the ability of the company to generate FCF for every dollar of sales. In this case, Juniper is able to transform ever $1 of sales into $0.23 in FCF. Any company that does more than 10% in FCF/S is a cash machine. There has been an increase in debt, but it is easily serviceable with the magnitude of their FCF.

CROIC is a cash version of ROIC. To explain it simply, it measures how well a company is generating cash off its investments. A CROIC of 17% is above average. My rule of thumb is to look for CROIC above 13%.

Juniper Value Factors

source: Old School Value Quality Score

For starters, the quick valuation multiple I use to track and rank the value score is determined by P/FCF and EV/EBIT.

P/FCF because it’s hard to go wrong buying companies at a cheap multiple to FCF.

EV/EBIT because it just works. There are plenty of papers and research that show how buying low EV/EBIT stocks outperform. Tobias Carlisle likes to use a modified version of EV/EBITDA in his Acquirer’s Multiple formula. Joel Greenblatt uses the inverse for his magic formula yield.

Leave A Comment