Dollar Rallies – Stocks Rebound On Tuesday

The dollar is set against the world stage. The word contagion was used constantly in the media on Monday. Anything is possible, but it was always extremely unlikely that a Turkish collapse would hurt the stability of the EU. And certainly not the stability of the dollar.

It looks more like that was an excuse to sell off now that the S&P 500 recovered a lot of the losses. It was up 0.64% and the Russell 2000 was up 1.03% on Tuesday. The VIX returned to the summer doldrums as it was down 9.95% to 13.31. With the S&P 500 about 1% from its record high.

The CNN Fear and Greed index is at 58 out of 100 which signals greed. It signals a strong dollar also.

It’s possible that the S&P 500 gets back to near extreme greed again when it takes out the record high. That’s because the market didn’t correct fully. I expected it to fall 3%.

The best sector on Tuesday was consumer discretionary as Amazon was up 1.24% to an all-time high. The worst performing sector was utilities which was up 0.17%.

Dollar and Recovery For Turkey Not For China

The Turkish collapse was overdone so there was a snapback rally. The Vanguard emerging markets index was up 0.6%. While Turkey recovered, China is still in a downturn. The Shanghai Composite fell 1.31% on Wednesday. It’s only 1.5% above its 52 week low it made on August 6th.

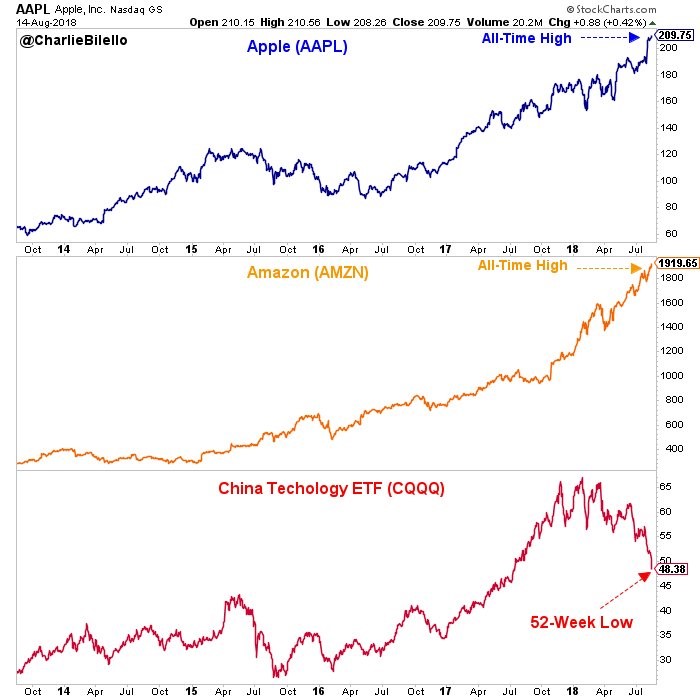

The chart below shows a ‘tale of two cities’ as American tech stocks such as Apple and Amazon have rallied to all-time highs while the Chinese technology sector is at its 52 week low.

Baidu stock is down 20.35% since July 12th and is also at its 52 week low. Tencent Holdings is down 26.5% since January 23rd. The Chinese economy was already weakening regardless of the trade war. It’s safe to say America is winning the battle since the S&P 500 and dollar is near its record high.

The Turkish lira was up 8% to 6.36 versus the dollar and the Turkish stock market ETF was up 11.3% which was its biggest once-day increase since 2008. The country’s currency and stock market increased because the finance minister will speak with investors about Erdogan’s policies.

Leave A Comment