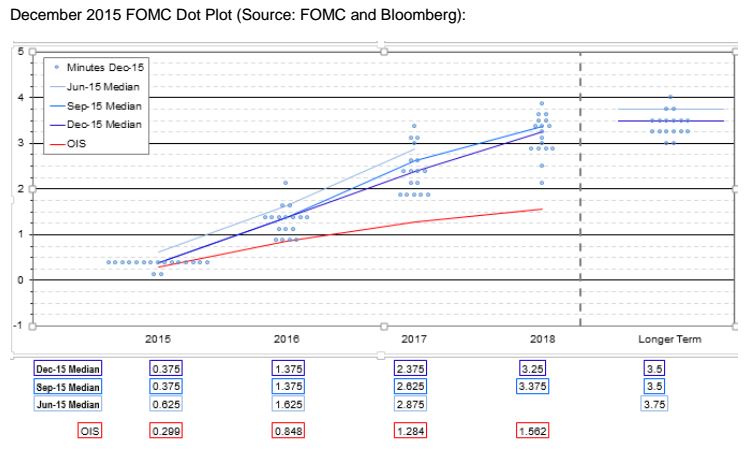

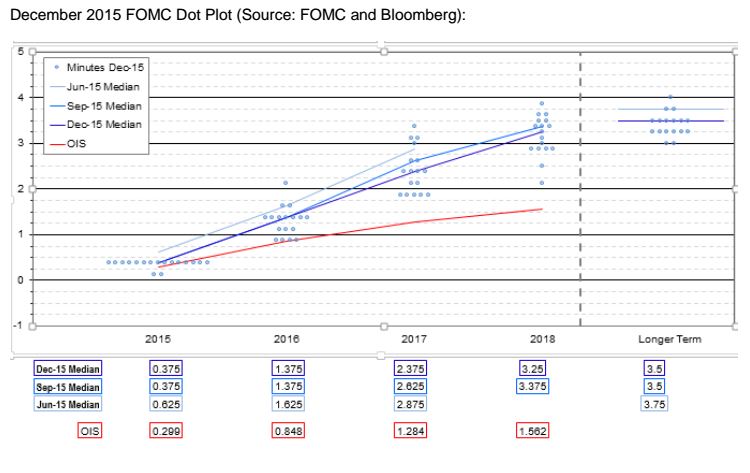

In the two days since the Fed raised interest rates for the first time in nine years and the first time it moved to a tightening bias in eleven years, it has become apparent that many media figures and market strategists are misreading, or at least misinterpreting, the Fed dots, in my opinion. The most recent iteration of the Fed’s “dot plot” forecast indicate that, when FOMC member opinions are averaged, the consensus opinion calls for a 1.375% Fed Funds Rate. Based on journalistic commentary and investment strategy I have read, the average opinion is being misunderstood as a Fed target for the Fed Funds Rate. This is not the case. The Fed “dots” are merely personal opinions of various FOMC members. They are in no way “policy targets.” Not only are they not targets they are widely disparate.

As can be seen, four FOMC members believe the Fed Funds Rate should be below 1.0% by the end of 2016. Three members believe that Fed Funds should be 1.0%. Seven members believe a 1.375% Fed Funds Rate might be appropriate, two believe a 1.75% Fed Funds Rate might be appropriate and one FOMC member believes a Fed Funds Rate of just over 2.0% might be appropriate. As you can see there is nothing “policy” about the Fed’s dots. Even so, why does the market have such little confidence that the Fed dots provide valuable guidance for future policy rates? A look at past Fed dots will explain why.

In September 2014, the Fed Dots indicated that, by now (the end of 2015) two members saw the Fed Funds Rate at 0.00% to 0.25%. One member saw it at about 0.375%. Three members saw the Fed Funds Rate at 0.75%. Two members saw Fed Funds at 1.00%. Three members saw the Fed Funds Rate at about 1.25%, one at 1.5% and four saw the Fed Funds Rate at 1.75%. This works out to an average of 0.95%. As we now know, the Fed “dots” were too high. The Fed dots widely missing expectations is not a recent phenomenon. Let’s look back to September 2013.

Leave A Comment