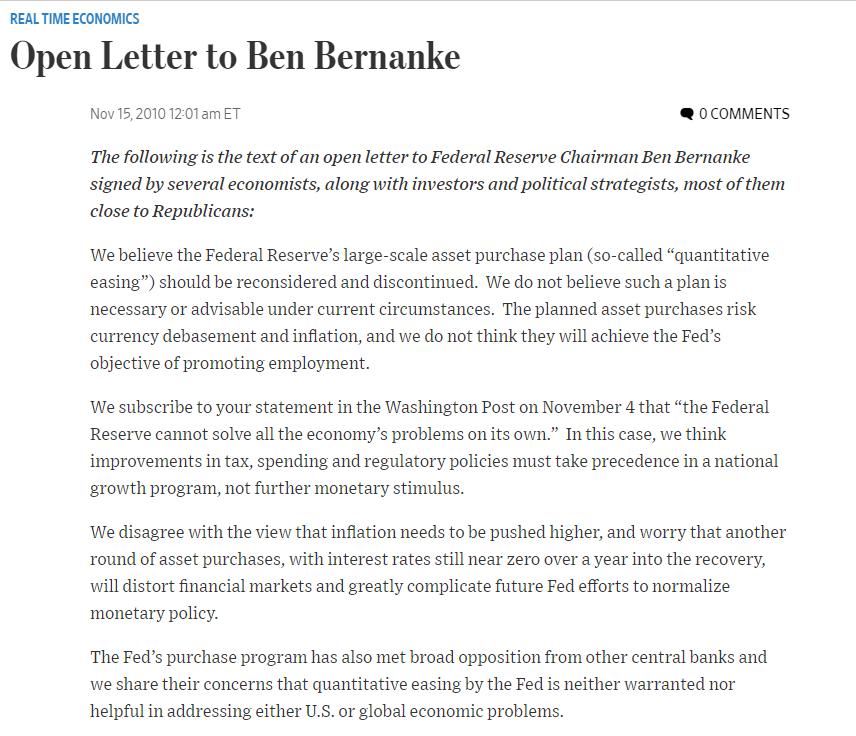

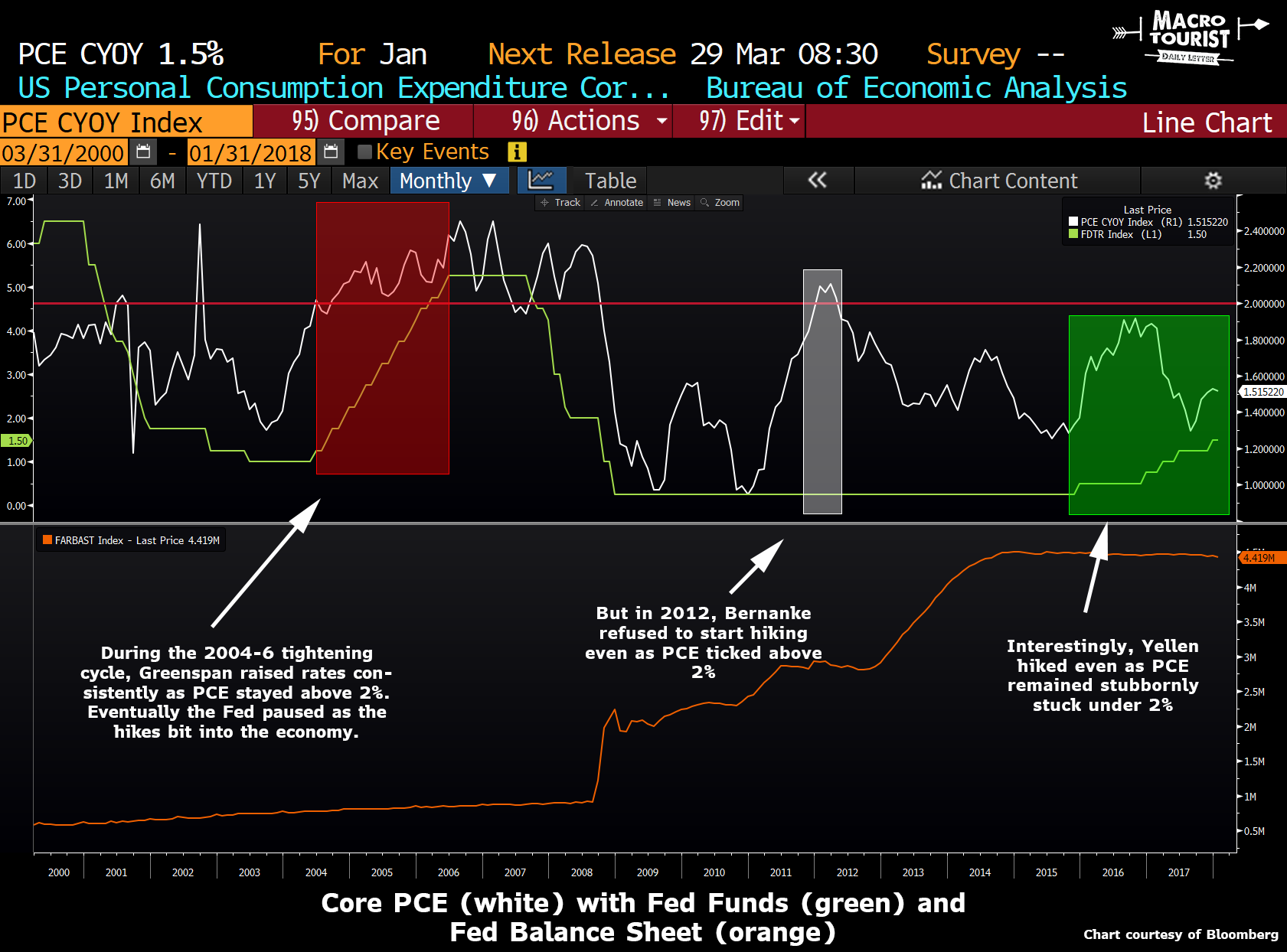

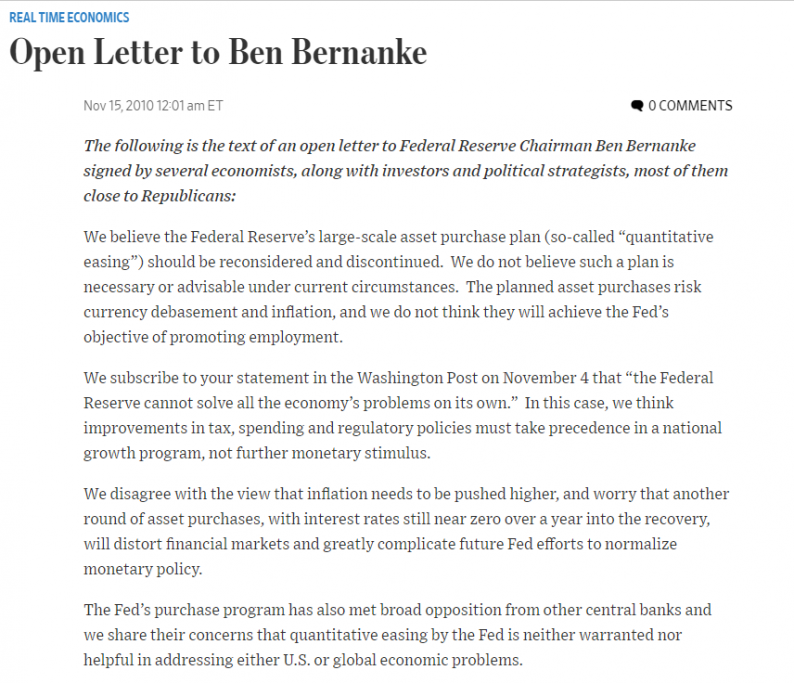

I would like take you back to 2012. Just a few short years after the soul-searching-scary Great Financial Crisis of 2008-9, market participants had finally given up their worry of the next great depression enveloping the globe, but had replaced it with an equally fervent fear that inflation would uncontrollably explode. The Federal Reserve had recently completed their second round of quantitative easing, much to the chagrin of a large group of distinguished economic thinkers who had gone as far as writing an open letter to the Fed Chairman pleading he reconsider the program.

You remember that old A&E show Intervention? Well, this was like an academic peer episode – more neck beards and sophisticated language, but sadly, the same amount of crying.

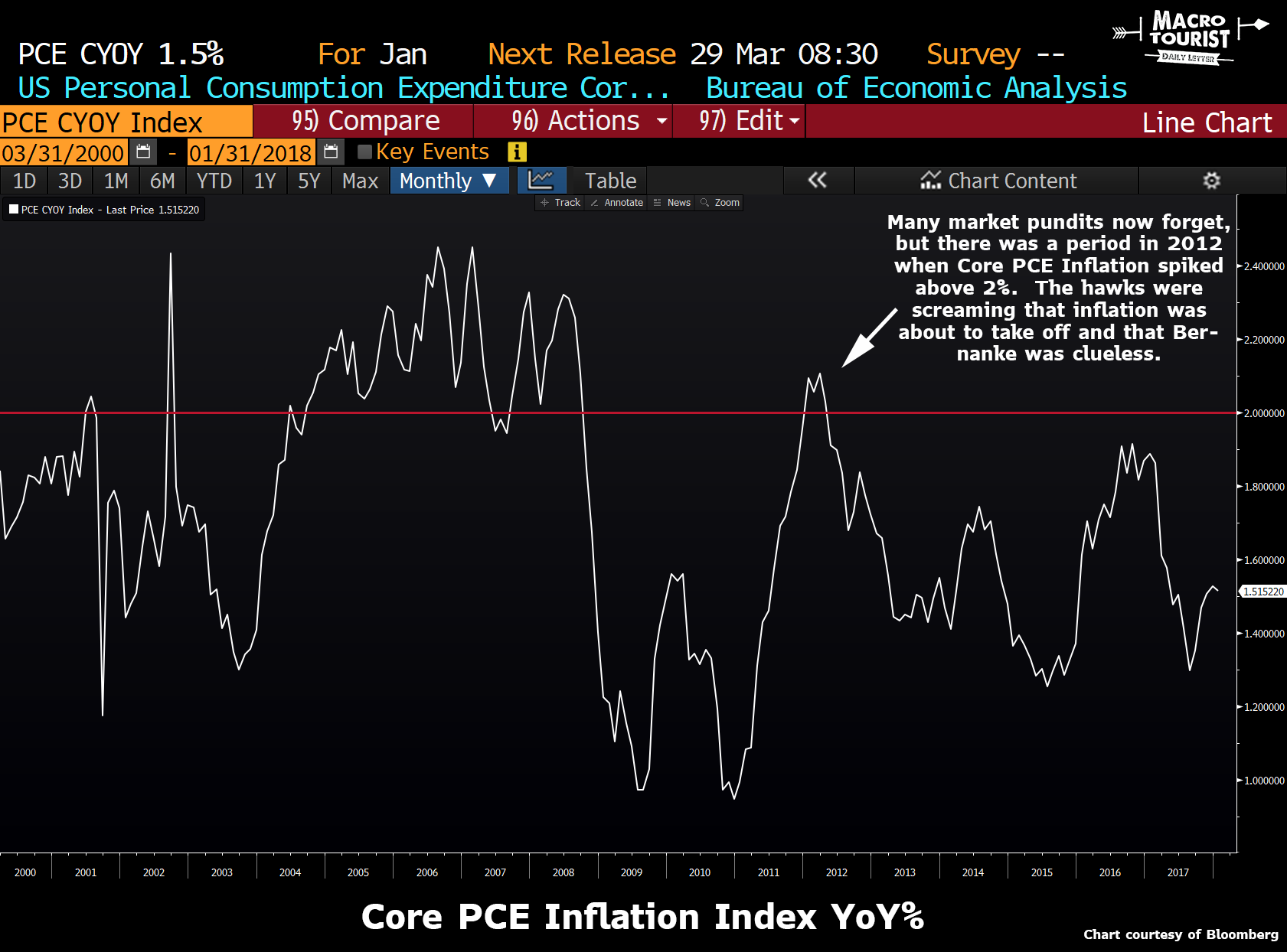

So when the Fed’s favourite inflation gauge, the Core PCE index, spiked up to 2% in 2012, it was especially hard on Chairmen Bernanke. After all, his colleagues had just warned him that this was about to happen.

Like any good addict, Bernanke insisted he had his usage under control.

In fact, during a 60 minutes TV interview, when faced with the question about how confident he was that he could control inflation, he responded – “100%.”

Yet, here was Bernanke, staring down the barrel of 2% inflation, having done nothing to prepare the market for higher rates. He believed the inflation was “transitory” and it would be a mistake to nip off the budding recovery with tighter monetary policy.

The hawks went ape-shit. They screamed and yelled. They warned about Weimar Republic style hyper-inflation. But Bernanke hung tough.

This was bold. It took guts.

Now you might think it was wrong – so be it. I am not so omniscient to give judgment, but more importantly, it’s in the past, so arguing is as about as interesting as when your 98-year-old grandma tells you that she was once “quite a dish.” Yeah sure, it might be true – but it ain’t doing anything for anyone today.

Leave A Comment