U.S. President Donald Trump’s decision to withdraw from an international agreement to curb Iran’s nuclear program has resulted in significant sanctions being re-imposed on Iran’s financial, automotive, aviation and metals sectors. As well, the Administration has set Nov.4th as a deadline for Iranian oil buyers to completely cut their purchases to avoid American sanctions.

Iran is still one of the largest oil exporters in the world, so the threat to cut Iranian oil supplies has already tightened up the market. Some experts are speculating that oil prices could rise to above $100 per barrel because other major producers could not easily fill the void.

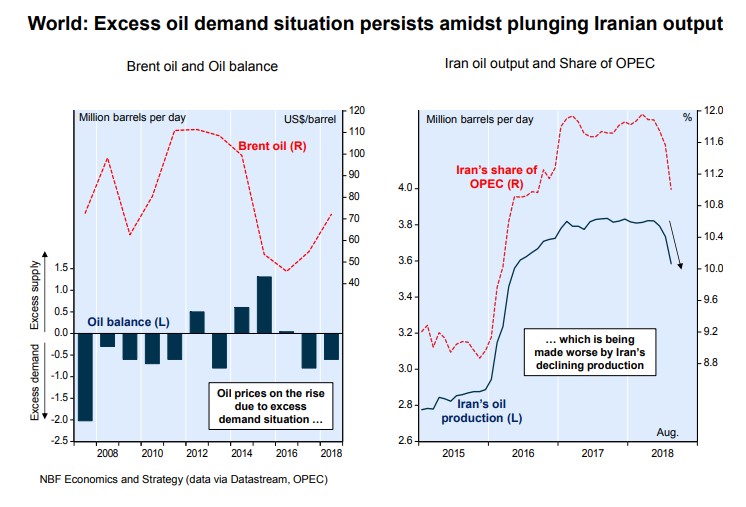

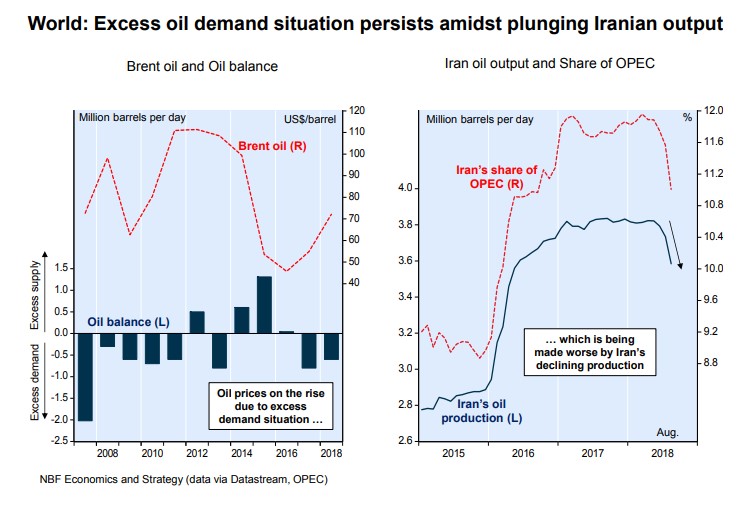

As a recent National Bank Hot Chart report confirms (September 21, 2018) Iran’s oil production started to decline several months in advance of the scheduled American sanctions in November. What has been happening is that several of Iran’s trading partners reduced their oil imports in advance of the scheduled November date, which then forced Iran to cut production. The following chart illustrates that Iran’s oil output is now hovering close to 3.5 million barrels/day, down more than 6% from the peak reached last December.

In other words, there is still considerable upside potential for oil prices, even more so if global economic growth continues to be strong. Global benchmark Brent crude slid recently slid below $80 per barrel, partly because of the concerns that the US-China trade war could weaken crude demand in China. Saudi Arabia recently announced plans to lift crude output to 10.7 million barrels per day (bpd), the Kingdom’s highest level ever.

Nonetheless, the concept that the Saudi Kingdom could replace Iran’s crude exports is clearly wrong.

Leave A Comment