One of the major topics to emerge among financial professionals over the past week in the aftermath of the latest violent market move lower was whether the “Fed Put” would come into play, and at what level, and just as importantly, what happens to markets – both stocks and bonds – as this new put level is repriced by market participants.

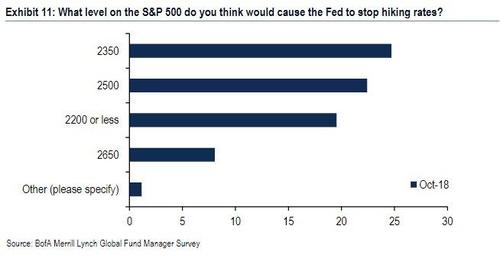

As we discussed last Thursday, in one of its questions in the latest Fund Managers Survey released last week, Bank of America asked “what level on the S&P 500 do you think would cause the Fed to stop hiking rates?” What it found is that according to the respondents, the Fed would stop hiking if the S&P 500 fell to 2390, suggesting the “Powell put” strike price is about -12% below current levels.

Other banks discussed last Thursdayin with: according to BNP Paribas, a 6% drop in the S&P 500 Index to 2,500 would be the resistance level that would prompt a response from Powell. “A 10 percent to 15 percent drop in equities is usually the difference between noise and signal,” BNP Paribas analysts said in a note. Meanwhile, Evercore ISI has put the “Fed Put” below the 2,650 mark.

Other were more skeptical, with BlackRock and River Valley Asset Management say the real economy remains relatively insulated from the stock meltdown. “The correction that we’re seeing in the stock market obviously is something that they pay attention to,” Scott Thiel, deputy chief investment officer for fundamental fixed income at BlackRock in London said in an interview on Bloomberg TV. But “the bar is very high to change Fed monetary policy.”

Andre de Silva, global head of emerging-markets rates research at HSBC, was even more blunt, telling Bloomberg TV on Thursday that the Fed needs something “more dramatic” than a stock rout to convince them to stray off course. And looking at corporate bonds – a key component of financial conditions – where the market rout has yet to inflict much pain, the HSBC analyst may have a point: the spread of junk bonds over investment grade credit has narrowed about 14 basis points this year and has barely budged wider, largely due to a sharp drop off in supply. Another place to look: rate vol, which was remained surprisingly dormant during the latest stock market rout.

All of the above opinions, however, do not change the fact that the recent drop in equities has already led to a substantial tightening in financial conditions. Last weekend, before the latest weekly rout, Goldman analysts calculated that the bank’s Financial Conditions Index (FCI) has tightened by 32bp since October 2, noting that the recent stock sell-off was the major driver of the tightening, as shown in the chart below.

Summarizing these various observations, over the weekend Deutsche Bank’s derivative strategist Aleksandar Kocic wrote that the recent market turbulence has been “predominantly the equity story in response to restriking of the Fed put”, which while affecting all markets, when compared to other sectors, equities continue to deliver outsized moves.

He shows this in the chart below which illustrates the equity- credit interaction, and echoes what Goldman said a week ago, namely that the Fed is tightening financial conditions via equities and the market’s renewed concern about the level of the “Powell put”:

Leave A Comment