There is a 100% chance the Fed will raise rates today.

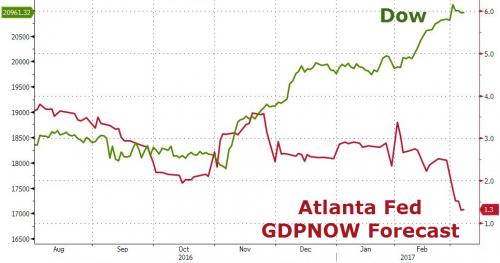

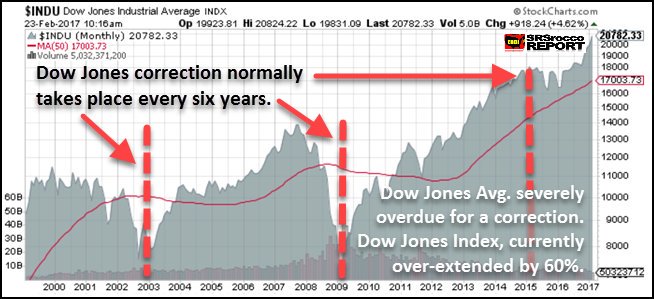

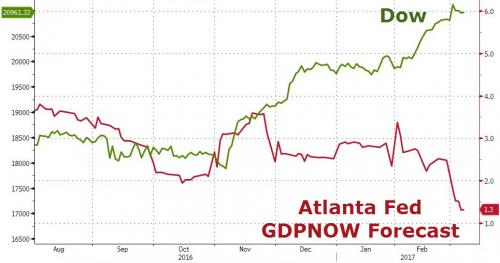

That’s the consensus and I, of course, agree as I’ve been saying they HAVE to hike since the last meeting. Now that everyone agrees with me, let’s move on to contemplating the result of the Fed hiking and what it means for the year ahead. Clearly, as you can see from the chart, the Fed is not hiking rates because the economy is booming. The Fed is hiking rates to ward off inflation because a stagnant economy with inflation (stagflation) is even worse than a recession from the Fed’s point of view.

Also, the markets are what Allan Greenspan liked to call “irrationally exuberant,” which is also clear from the chart and it’s also not good to see so much money chasing so little profit as it’s a classic misallocation of resources and, while investors may not feel the need to worry about the future consequences of their current actions – the Fed certainly does and it is their job to pop these bubbles – as gently as possible.

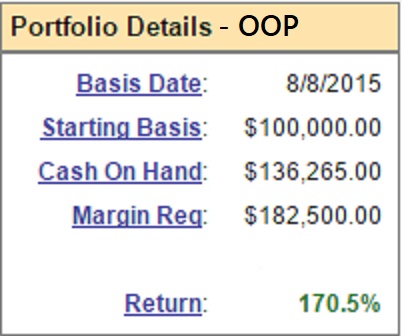

Having a well-balanced portfolio is the key to long-term success. You can’t only make money in bullish markets or only make money in bearish markets or those dry spells can kill you. Smart Portfolio Management is more like surfing, where we look for a good wave to ride and then try to stay on board for as long as we can and try to cash out before the wipeout. When it’s over, we paddle our cash back out to sea and look for the next exciting opportunity.

Though we are generally long-term investors, we are not adverse to taking short-term profits. We have even cashed in our beloved Apple (AAPL) stock from time to time, because nothing goes up forever and, unlike Buffett, we don’t feel the need to “ride out” the corrections.

The other very important aspect to our portfolio strategy is HEDGING and it’s surprising how many “investors” don’t know how to hedge properly – including hedge fund managers! We adjusted our hedges in the OOP on March 1st, using the ultra-short Russell ETF (TZA) and the ultra-short Nasdaq ETF (SQQQ) as our primary hedges. TZA is now at $19.12 and it’s a 3x ETF so a 5% drop in the Russell (to 1,294) would pop TZA 15% to $22.

Leave A Comment