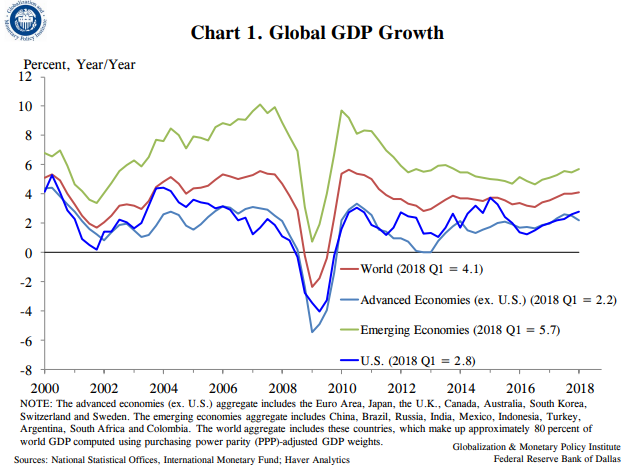

Although many signs seem to suggest that a peak has been reached in the growth rates of the advanced economies, the outlook is more uncertain for the emerging market economies.

Virtually all advanced economies are coming off relatively strong job markets with unusually low and stable inflation. China, India and the U.S. are expected to be the largest contributors to the 4% global growth outlook.

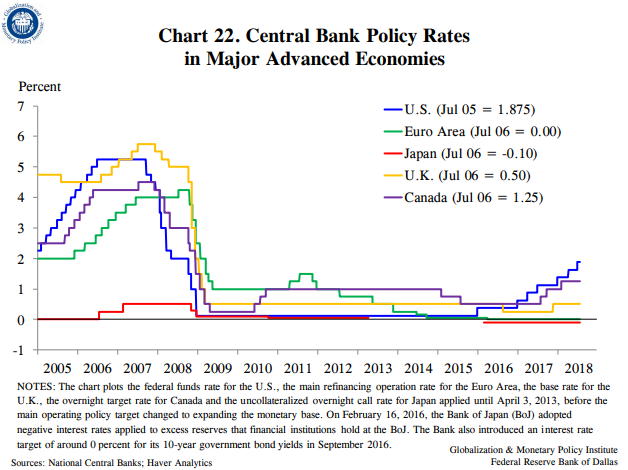

Monetary accommodation is still working its magic, though in the U.S. monetary stimulus is being gradually eliminated by interest rate increases and the shrinking of the Federal Reserve’s balance sheet. Central bank accommodation is also starting to ease back in Canada, Europe, and the United Kingdom. Most of the advanced economies are also experiencing some fiscal easing, and in the wake of their strengthening economies, labor shortages are starting to emerge.

Although wage and price inflation continue to be relatively modest in the U.S. and Canada, these indicators have turned a corner and are projected to increase moderately through to the end of next year.

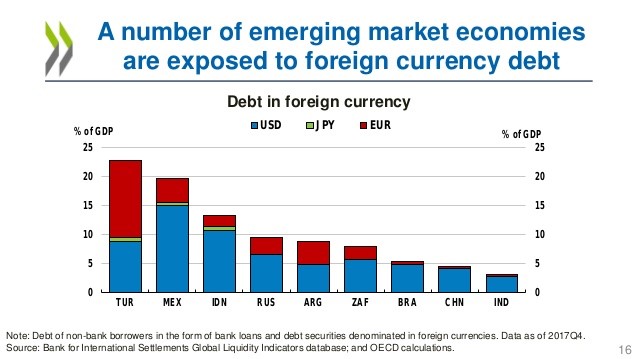

Of course, the somewhat rosy economic outlook for the advanced economies is predicated on no major economic or financial shocks, an assumption which seems rather naïve in the current context of a possible trade war. Among the most prominent worries on the horizon (higher oil prices, the major escalation financial debts, trade wars, Brexit), the one major problem that does not seem to have been given enough credence is the emerging market countries indebtedness to the advanced economies.

A number of these countries (e.g. Turkey and Argentina) have relatively huge exposure to foreign currency denominated debt. Of course, as their local currencies plunge, (and for Turkey this has already occurred) this would shift their economies into a currency crisis.

Assuming No Major Economic Shocks, Advanced Economies Growth Will Likely Moderate A Bit Next Year

Leave A Comment