Last week, I discussed the primary issue that has led to the “Unavoidable Pension Crisis” in America. To wit:

“Using faulty assumptions is the lynchpin to the inability to meet future obligations. By over-estimating returns, it has artificially inflated future pension values and reduced the required contribution amounts by individuals and governments paying into the pension system.”

This is a critically important point to understand. Why? Because you may well be in the same “quicksand” as pension funds and just don’t realize it.

For years, Wall Street has continued to espouse the “myth of compounded average returns.” This is the same myth which has not only infected pension funds, but has led to the same false sense of future financial security in personal retirement planning nationwide. An article from IBD last week further perpetuates this myth:

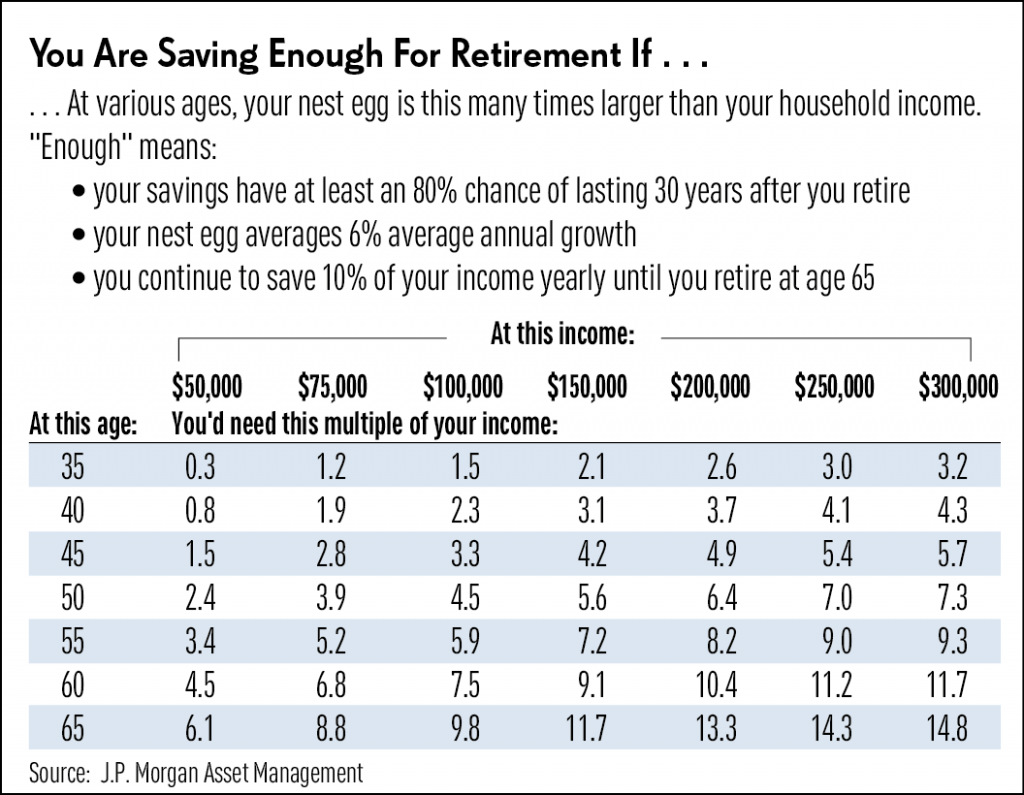

“What determines how much savings is enough by a certain age, with a particular income?

J.P. Morgan says ‘enough’ means the nest egg is big enough to have at least an 80% chance of surviving 30 years in retirement.’ So, 20% of the time you’d need to course correct — by boosting something like your savings rate or cutting your retirement spending — to avoid running out of money in the long run. But 80% of the time, you would not need to make any changes to avoid running out of money.’

The financial firm’s number crunchers also assume that, before retirement, you keep kicking in 10% of your income each year to your nest egg. In addition, they assume that your retirement portfolio grows an average of 6% a year before retirement and 5% a year in retirement.“

And there it is. The biggest mistake you are making in your retirement planning by buying into the “myth” that markets “compound returns” over time.

They don’t. They never have. They never will.

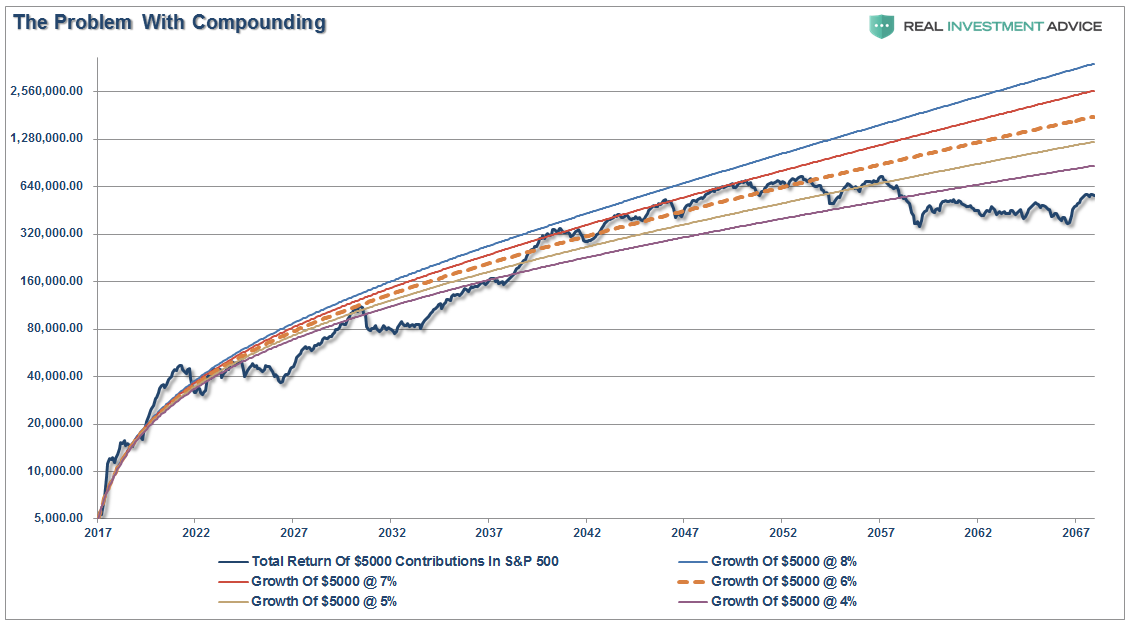

I have adjusted the chart I showed you last week to show a compound return rate of 6%, $5000 annual, made monthly, contributions (10% of $50,000 which is roughly the median wage) and using variable rates of return from current valuation levels. (Chart assumes 35 years of age to start saving and expiring at 85)

As you can see, markets do not compound average returns over time.

Most importantly, just as with “pension funds,” the issue of using above average rates of return into the future suggests one can “save less” today because the “growth” will make up for the difference.

Leave A Comment