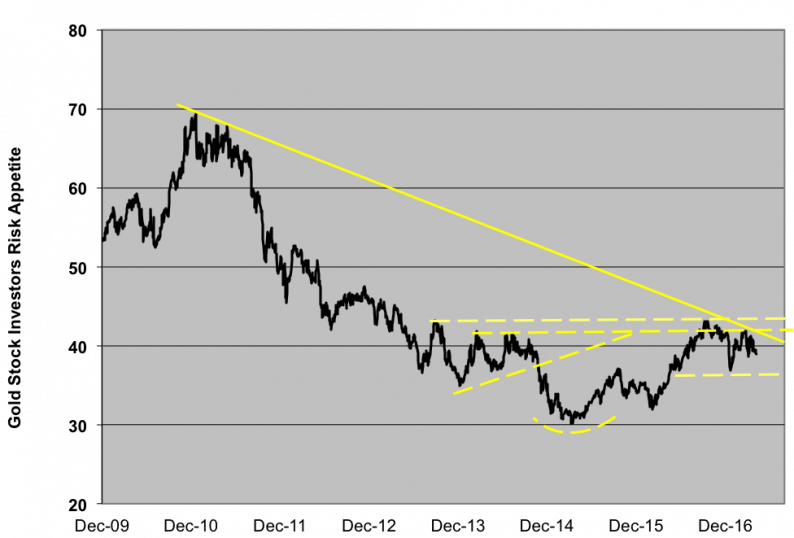

SPX Monitoring purposes; Sold 4/5/17 at 2352.95= .4% gain; Long SPX on 3/24/17 at 2343.98 Monitoring purposes Gold: Sold GDX at 24.33 on 2/22/07 = gain 20.15%; Long GDX on 12/28/16 at 20.25 Long Term Trend monitor purposes: Neutral For

April 10, 2017