Whilst gold has found some much needed and welcome bullish momentum, the same cannot be said for silver, which failed to benefit from the recent flight to safe haven, one of the primary drivers for gold.

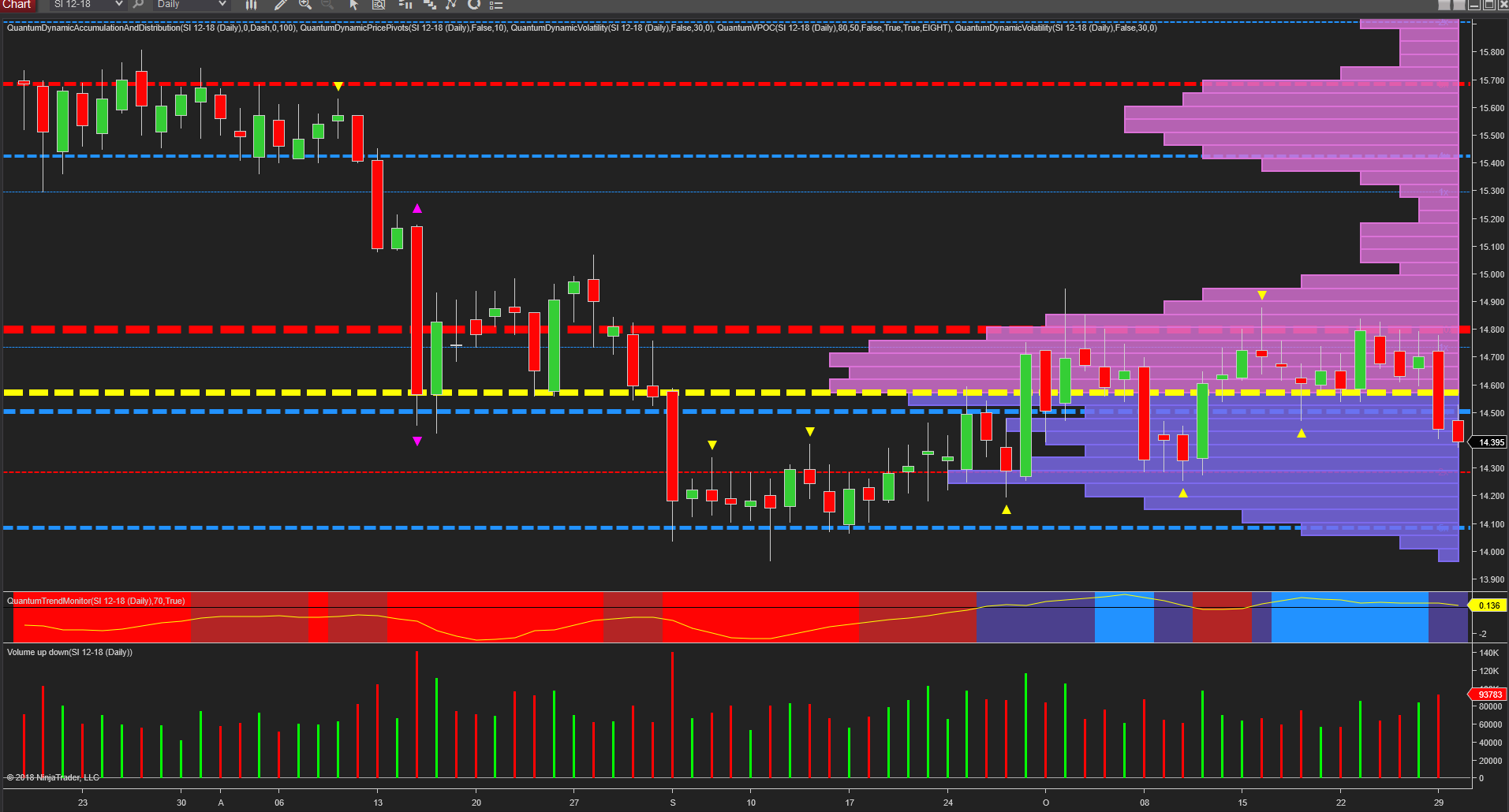

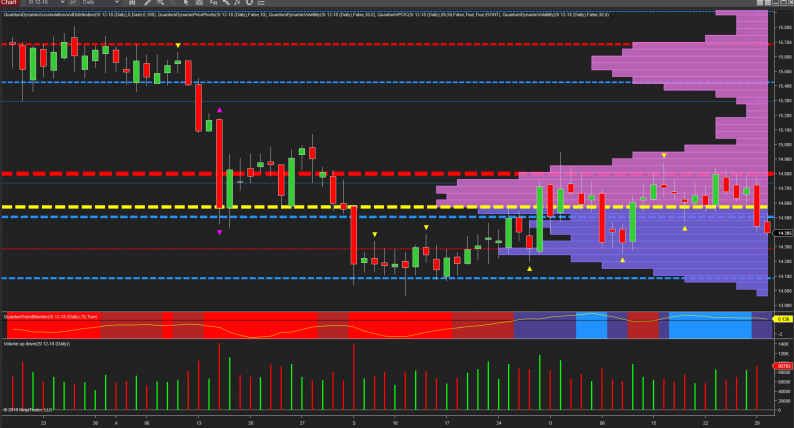

For silver, the price action of the last two months has been condensed and contained within a very tight trading range, with the ceiling of resistance clearly defined at $14.80 per ounce and the floor of support equally well described at $14.10 per ounce. The heavy red dashed line depicts the ceiling of resistance on the accumulation and distribution indicator, with the blue dashed line denoting the floor, and whilst both are significant, it is the ceiling of resistance which is currently capping any advance higher for silver. The $14.80 per ounce level has been tested repeatedly throughout October, and as a result, the volume point of control itself is now centered at $14.55 per ounce and shown by the yellow dashed line. This denotes the fulcrum of the market at present for silver, and also the heaviest concentration of volume on the daily chart, so we can expect to see further congestion follow for the time being.

Once silver breaks away from the current consolidation phase, volume will confirm any move and should the floor of support ultimately be breached, with low volumes below in the $14 per ounce area on the VPOC histogram to the right of the chart, it could be a swift journey. Yesterday’s selling pressure was clearly in evidence with the metal closing with a wide spread down candle on high volume, and the minor rally higher in early trading has already been snuffed out as silver trades at $14.40 per ounce at the time of writing.

Leave A Comment