It all started early last night when the front month oil contract dipped below $28 giving a taste of what was to come. It was all downhill from there.

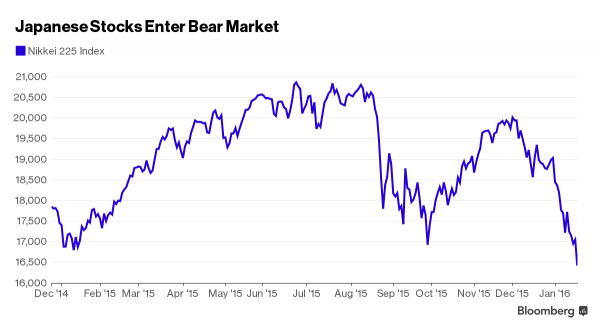

First Chinese stocks ended the recent ramp higher, with the Shanghai Composite closing down 1% back under 3000, then Japan’s rout accelerated with both the Nikkei (-3.7%) and the Topix Index sinking into bear markets, both falling more than 20% from their 2015 highs.

The rout then spilled over to Europe, where the Stoxx 600 is down 3% to the lowest level in 13 months, and finally making landfall in the US where the E-mini is down 1.8%, trading at 1840, meanwhile WTI is back under $28 while the USDJPY plunged to a one year low and barely rebounded despite an attempt at verbal intervention when an unknown Japanese government source said they are “closely watching currency movements”, which lead to a 100 pip spike in the pair that was promptly faded.

In sum: the world is on the verge of a global bear market, exacerbated by an ongoing earnings deterioration which has sent the MSCI gauge of global equities to the brink of a bear market. But the biggest driver remains oil whose slump to a new 12-year low is ripping through markets. Just on Wednesday, Royal Dutch Shell Plc (RDS-A) said profit may drop at least 42 percent in the fourth quarter. U.S. bonds now predict the slowest inflation since May 2009.

Commodity currencies were slammed with Russia’s ruble and Mexico’s peso falling to record lows, while bets mounted on an end to Hong Kong’s dollar peg.

Saudi Arabia also launched capital controls when it was reported overnight that it had ordered a halt to Riyal forward option trades.

Yields on 10-year Treasuries dropped below 2 percent and the yen jumped to a one-year high.

“It’s back to oil and that’s what is driving everything at the moment,” Barra Sheridan, a rates trader at Bank of Montreal in London told Bloomberg. “We can easily run more because it’s pure fear. I don’t know what we need to change this sentiment.”

Well a central bank intervention or two would help. For now, this is where the “running” has taken global assets as of moments ago:

A quick jog through the markets:

Asian equity markets traded with heavy losses after the continued weakness in energy prices, with WTI Mar`16 futures falling below USD 29/bb dampening sentiment across the region. Subsequently, the MSCI Asia-Pac reached 4 year lows, while the Nikkei 225 (-3.7%) fell into bear market territory after falling 20% from August highs and ASX 200 (-1.3%) was also dragged lower by the energy complex, while the latter was also weighed by losses in basic materials after the index’s 3rd largest Co. by market cap BHP Billiton cut its FY iron ore guidance.

Elsewhere, the Shanghai Comp. (-1.0%) conformed to the region’s negative tone and declined back below the 3000 level, while the Hang Seng (-3.8%) was pressured by losses in large casino and energy names with CNOOC also lowering its capex and production guidance. Finally, 10yr JGBs remained relatively flat, with trade mostly uneventful despite the risk-averse tone and BoJ entering the market to purchase JPY 1.27TN bonds.

Top Asian News

In Emerging Markets, the MSCI EM Index dropped the most in two weeks, sinking 2.8 percent to the lowest on a closing basis since May 2009. The gauge is down 12 percent this year, the worst start since records began in 1988. Hong Kong’s Hang Seng China Enterprises Index tumbled 4.2 percent as oil producers plummeted and a drop in the city’s dollar spurred concern over capital outflows. The Shanghai Composite Index slipped 1 percent.

Russia’s Micex Index slid 1.7 percent and the Bloomberg GCC 200 Index of equities in Gulf markets lost 3.2 percent. Saudi Arabia’s Tadawul All Share Index declined 4.5 percent and Dubai shares sank 4.6 percent. Egypt’s benchmark slid 4.5 percent. Russia’s ruble weakened as much as 2 percent to a record 80.1790 against the dollar. The Mexican peso fell to a record 18.4775 per dollar and is down 6.5 percent this year, making it Latin America’s worst performing major currency.

Saudi Arabian banks are under orders to stop selling currency products that allow investors to make cheap bets on a devaluation of the riyal, according to five people with knowledge of the matter. The Saudi Arabian Monetary Agency told banks not to sell options contracts on riyal forwards at a meeting in Riyadh on Jan 18., the people said, asking not to be identified as the information is private.

Leave A Comment