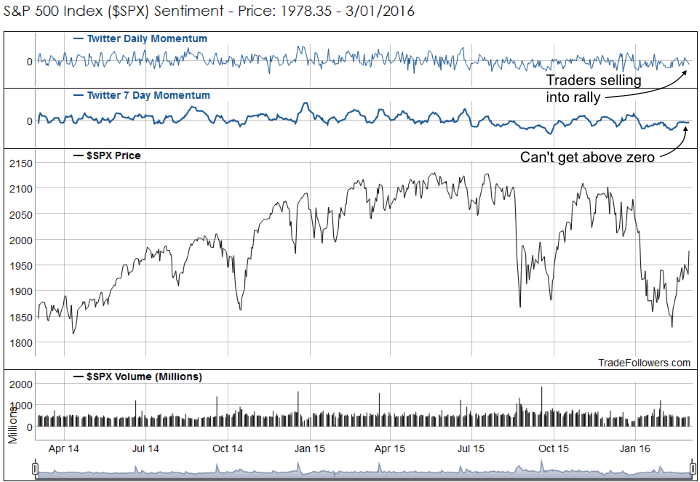

Even after yesterday’s strong rally, 7 day momentum for the S&P 500 Index (SPX) can’t get above zero. It appears that traders sold into yesterday’s rally, rather than getting excited for a sustained up move. Take a look at daily sentiment, it printed nearly -10 on a 2% up day. It makes this move look more like a bear market bounce than the start of a new bull.

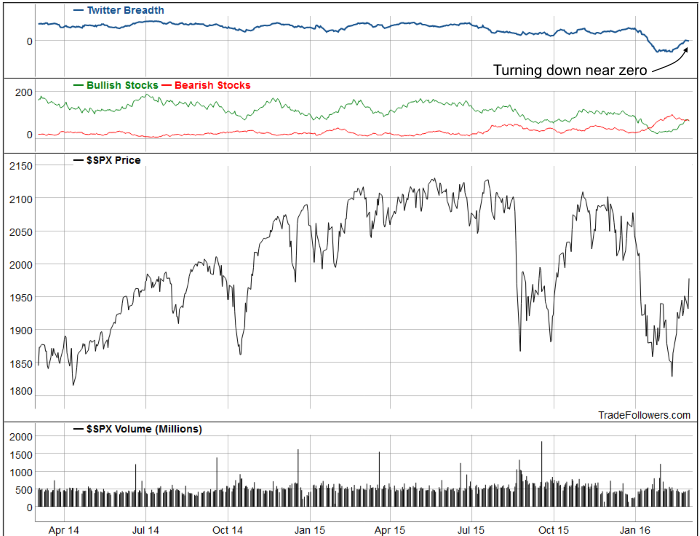

Breadth didn’t react to yesterday’s move the way I would expect in a bull market either. It looks like it might be rolling over as well. Something to keep an eye on over the next several days.

Conclusion

Sentiment and breadth from the Twitter stream are struggling to move higher as SPX rallies. Not the type of behavior we see in a bull market. We’re likely seeing a bounce in a bear. Be cautious, because we may be close to capping this rally.

Leave A Comment