On Thursday morning, following the systematic unwind that precipitated the worst day for U.S. stocks since February and the worst day for the Nasdaq since Brexit, Nomura’sCharlie McElligott penned a post-mortem of sorts.

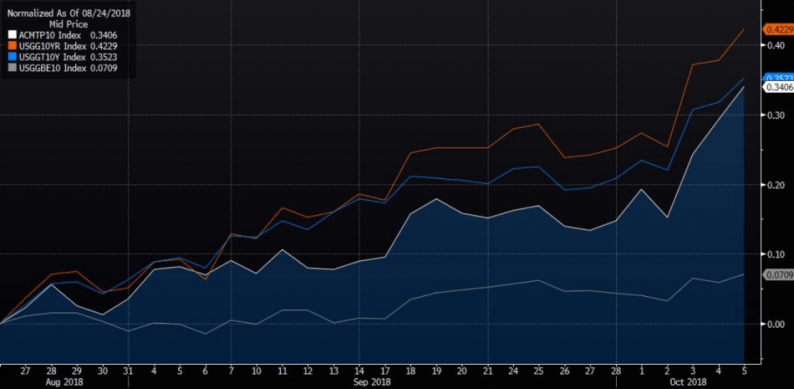

“Take this sloppy Equities deleveraging move for exactly what it is”, McElligott wrote, before pointing the finger at “the violent move in U.S. real rates and the re-pricing of UST term premium.” Below is a visualization of that point, which shows that the rates selloff has been driven by reals and the term premium trade, a scenario that’s harder for risk assets to digest than an inflation-led bond selloff.

(Bloomberg)

He also attempted to put some numbers on CTA deleveraging and documented the role option gamma hedging played during Wednesday’s rout.

While dissecting Wednesday’s drawdown is important to the extent we can derive clues about whether more systematic selling/forced deleveraging is in the cards in the days and weeks ahead, the more crucial point is this: What happened this week is still further evidence to support the notion that the low vol. regime was but a veneer of stability masking a potentially dangerous buildup of risk beneath the surface.

A simple way to think about the low vol. regime is to view it as a byproduct of the “Goldilocks” macro narrative. Synchronous global growth and well-anchored inflation allowed market participants to harbor an upbeat view about the global economy while still insisting that because inflation remained stubborn, developed market central banks had the cover they needed to keep policy accommodative.

But beyond that, the two-way communication loop between central banks and markets was the key determinant in encouraging the proliferation of the short vol. trade. That same communication loop helped transform “buy the dip” from a derisive meme about retail investors into a virtually infallible trading “strategy.”

Central banks only acted with the market’s consent and markets became aware of their role in the decision calculus. I will never tire of reminding you that this dynamic was best described by Deutsche Bank’s Aleksandar Kocic in a truly brilliant note from September 2015.

“Fed’s communication strategy, it is becoming clear, is an equivalent of what in theater context is referred to as Removing the fourth wall whereby the actors address the audience to disrupt the stage illusion — they can no longer have the illusion of being unseen”, Kocic wrote, before elaborating as follows:

An unalterable spectator becomes an alterable observer who is able to alter. The eyes are no longer on the finish, but on the course — what audience is watching is not necessarily an inevitable self-contained narrative. The market is now observing itself from another angle as an observer of the observer of the observers.

Kocic revisited that in August of 2016 as follows:

The fed is observing the market and the market is observing the fed; the Fed has no maneuvering space and the market knows that, and the Fed knows that the market knows, but, in order to preserve the underlying symbolic order, both sides pretend that the other does not know it — their gaze can never meet, there has to be an implicit agreement that this can never happen; it is in no one’s interest to call the other side on it.

Because of this, nothing is likely to happen in the long run, the most we can see is some short-term disturbance that is self-correcting. If the Fed attempts to hike and this turns out to be disruptive for the markets, its action will be corrected quickly, probably before the next FOMC meeting. Similarly, if the markets appear too calm and complacent, the Fed might attempt to squeeze in a hike in order to free some maneuvering space without significantly raising volatility or disturbing the markets. One way or another, the excitement can be only short-term.

Leave A Comment