My Swing Trading Approach

Low volume market today and for the remainder of the week. I am not looking to add much to the portfolio this week.

Indicators

VIX – Decent bounce yesterday, finishing the day at 10.25. I wouldn’t be surprised to see the shorts push this back down today.

T2108 (% of stocks trading below their 40-day moving average): Flat for a second straight day. At 63% still.

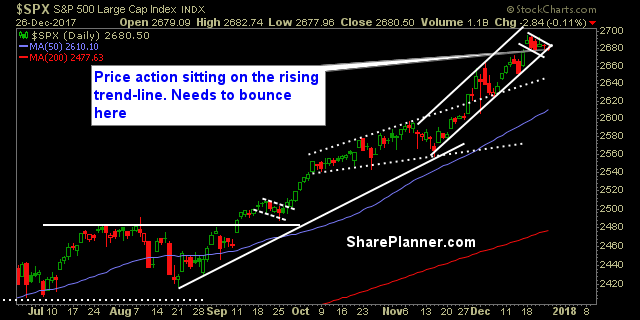

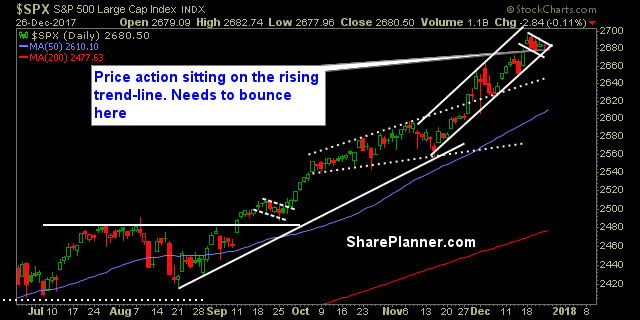

Moving averages (SPX): Closed below the 5-day moving average and may see a test of the 10-day MA going forward.

Industries to Watch Today

Energy still remains the hottest sector, but extremely stretched at this point. Same could be said for Basic Materials. Communication Services has been garnering some interest of late. Technology and Utilities are the weakest right now, but very much ready for a bounce at this point.

My Market Sentiment

Trend-line is still being tested -needs to bounce today, to hold it going forward. Today is also considered the start of the notorious “Santa Rally”.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment