Over the weekend, there was a purge in Saudi Arabia. What does it imply for the gold market?

It was a surprising weekend for Saudi Arabia. On Saturday, Crown Prince Mohammed bin Salman launched an anti-corruption probe, arresting several princes and dozens of government ministers, including Prince Alwaleed bin Talal, one of the wealthiest men in the world. These detentions fundamentally altered the structure of the state which has existed since the 1960s, as they were done as part of the consolidation of power by the son of King Salman.

Separately, Prince Mansour bin Muqrin, an important member of the Saudi royal family, and a few other government officials were killed in a helicopter crash on Sunday.

Meanwhile, the last few days also highlighted rising tensions in the region. On Saturday, Saudi Arabia intercepted a ballistic missile. The kingdom blamed the launch on Iran. And on Monday, Saudi Arabia said that Lebanon had declared war against it.

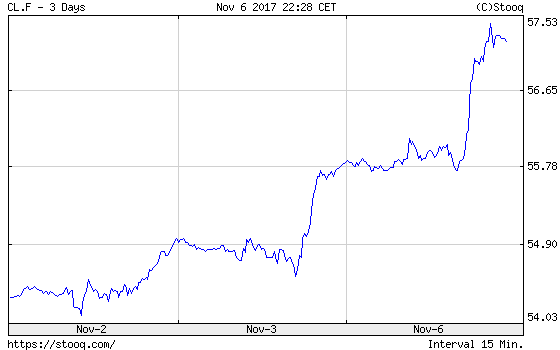

In a response to this series of bizarre news, the price of oil surged. Indeed, the WTI futures jumped above $57 a barrel, as one can see in the chart below.

Chart 1: Crude oil WTI on Nymex over the last three days.

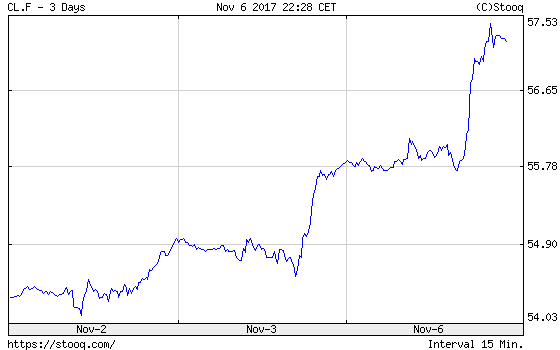

The combination of surging oil prices and a safe-haven demand due to geopolitical tensions made gold prices rally. As the next chart shows, the price of the yellow metal rose above $1,280 yesterday.

Chart 2: Gold prices over the last three days.

The jump in oil prices and the rise in uncertainty may support gold prices (crude oil often leads the commodities and its price spikes significantly add to inflationary pressures). However, yesterday’s moves may be only temporary as the events in Saudi Arabia may not change the country’s oil policy. It may be also the case that the markets are now more sensitive to the U.S. oil market rather than to the events in the Persian Gulf. Stay tuned!

Leave A Comment