We reviewed some preliminary negative economic implications from the fundamental side of the Semiconductor sector in an NFTRH update yesterday. As you may remember, the Semi sector compelled me to play it straight and call bull on the US economy in January of 2013.

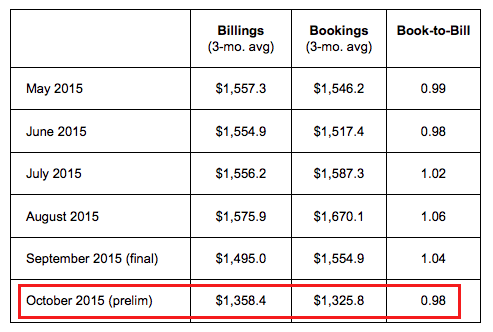

Here is the latest book-to-bill ratio data for the Semiconductor Equipment sector, AKA our economic canary in a coal mine. The ratio has declined in the past and we just yawned because it was simply a manifestation of strong billings out pacing strong bookings. This time? Not so much. It’s negative all around.

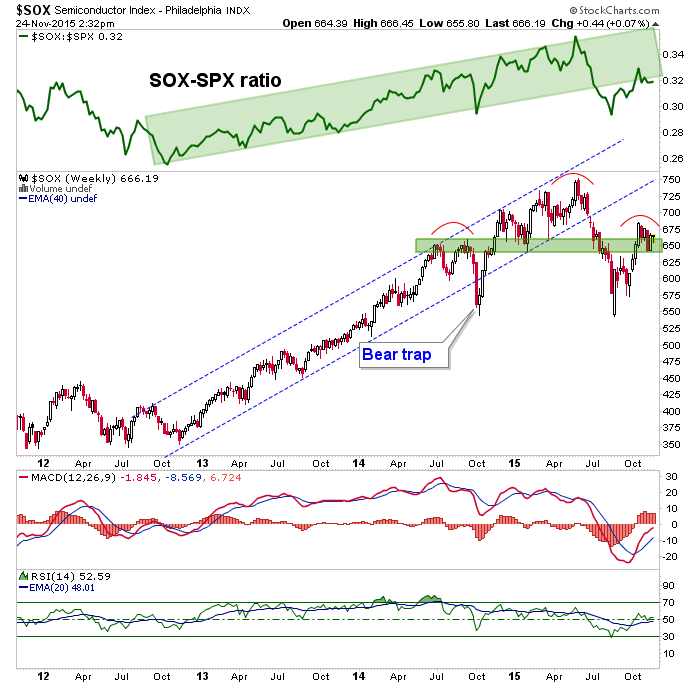

As you can see by the chart, SOX was a market leader from that time period (Q4 2012) when the Semi equipment sector gave its signal.A bear trap was obvious in October 2014 as we noted the sector was still healthy and the hype in the news (as supposed bellwether Microchip Semi issued a bogus forecast that Wall Street glommed on to) ridiculous.

But in 2015 the SOX broke the long-term trend again and has a questionable looking pattern (though it’s above key support) and the equipment sector’s fundamental data are – for one month at least – unfavorable. So it will be interesting to see what develops going forward. Watch the Semi’s because they are relevant to the economy and to the stock market.

Leave A Comment