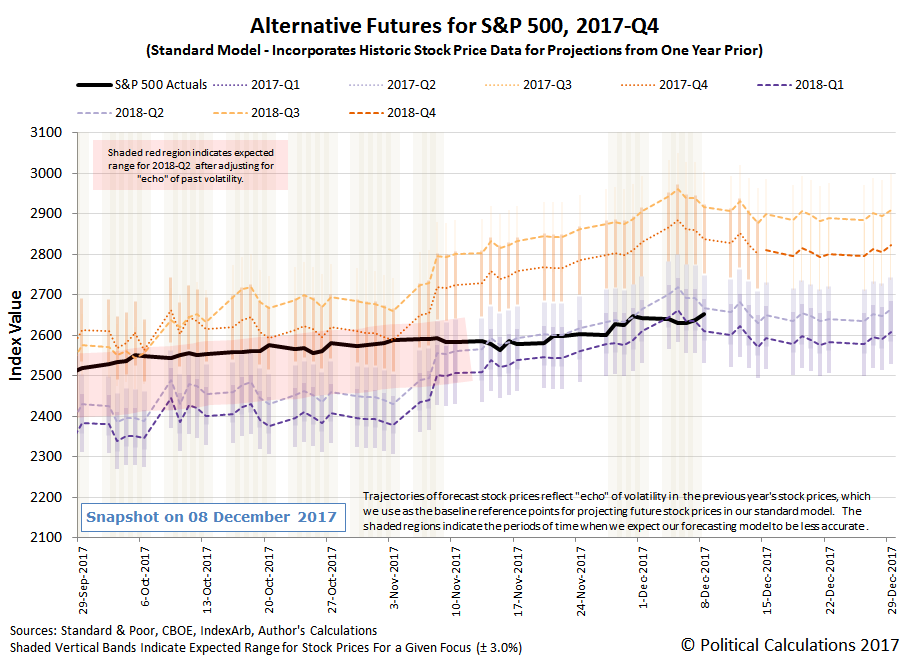

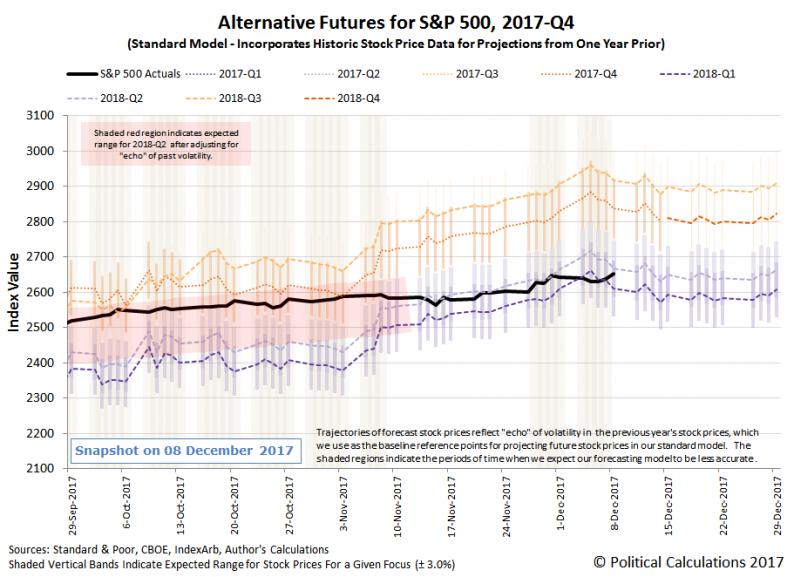

The S&P 500 behaved more as I expected that it would during the first full week of December 2017, with stock prices dipping as investors shifted their forward-looking focus to 2018-Q1 in setting current day stock prices.

But ended up on Friday, 8 December 2017 at a level that would at first appear to be more consistent with their being focused on 2018-Q2. The reason for that has a lot to do with the positive jobs report that came out on Friday, 8 December 2017, which had the official unemployment rate hold steady from the previous month at 4.1%, but which is down a half percent from November 2016. The report was stronger than expected, which appeared to clear the way for the Fed to not just announce that they will hike U.S. short-term interest rates this Wednesday, 13 December 2017, but up to three more times in 2018.

The CME Group’s FedWatch tool is reflecting that assessment, where after a 100% probability that the Fed will hike rates on this Wednesday (with a 90.2% chance they’ll hike them to a target range of 1.25%-1.50%, and a 9.8% chance they’ll hike them even higher to the 1.50%-1.75% range), the Fed Funds Rate futures suggest additional hikes in at least the first quarter of 2018 (2018-Q1) and again in the third quarter of 2018 (2018-Q3).

Leave A Comment