As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s negative it’s bad (though in 2015 lots of negatives were shrugged off as immaterial so as to avoid any acknowledgement of bad) but if it’s positive it can only be good.

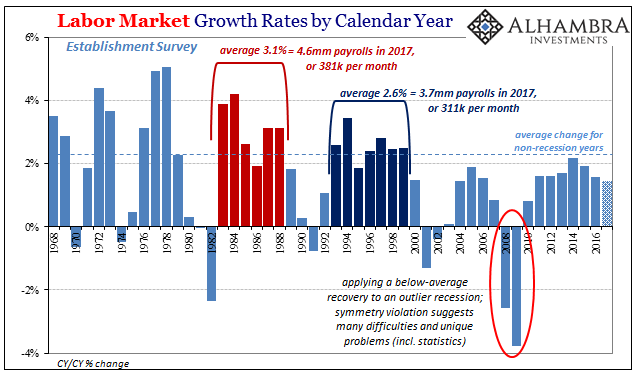

This is exactly how the US labor market is being treated. The headline payroll number was +228k for November, thus classified as “strong” when it is anything but. Using historical comparisons to properly calibrate our interpretations, +228k is significantly less than the average growth required to be reasonably consistent with a truly healthy economy. In fact, that level of growth is serious below where the labor market needs to be, meaning that next month there would have to be +400k in payrolls just for it to get back on track averaging +311k.

There’s absolutely no chance of that happening, which means something entirely different than “strong.”

So it is with other economic statistics around the rest of the world where actual growth levels are such a distant memory what is clearly far short of a minimal gain appears to be otherwise. China’s General Administration of Customs reports that the Chinese export of goods in November 2017 rose 12.3% year-over-year. That’s the highest rate of expansion since March.

Given that, and that the rate was double digits no less, the estimate is being characterized in the same way the US payroll figure is.

China reported strong growth Friday in both exports and imports in November in a reassuring sign for the world’s second-biggest economy.

Leave A Comment