Syndax Pharmaceuticals Inc. (Pending:SNDX) expects to raise net proceeds of $58.6 million in its upcoming IPO. Based in Waltham, Massachusetts, SNDX is a late-stage biopharmaceutical company that is developing therapeutics for cancer.

SNDX will offer 4.4 million shares at an expected price range of $14 to $16.

SNDX filed for the IPO on January 4, 2016.

Lead Underwriters: Citigroup Global Markets and Morgan Stanley

Underwriters: JMP Securities and Oppenheimer & Co.

Business Summary: Biopharmaceutical Company Developing Treatments for Cancer

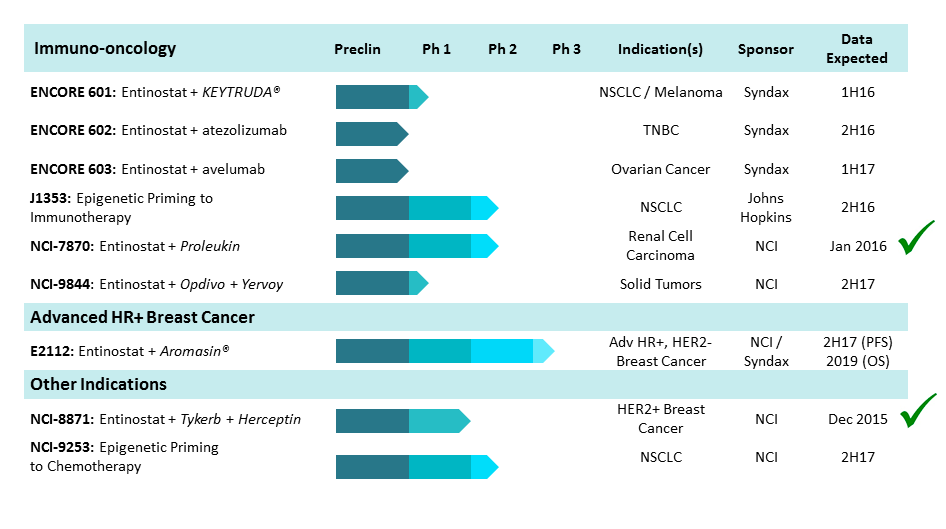

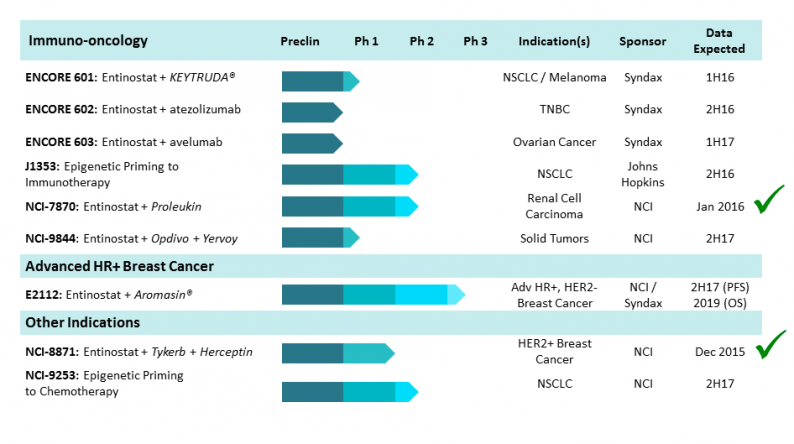

Syndax Pharmaceuticals is a late-stage biopharmaceutical company that is developing therapeutics to treat cancer. Its lead product candidate is entinostat, which is an epigenetic, oral, small molecule drug for treatment-resistant cancers, including lung cancer, breast cancer, solid tumors and hematological malignancies. As an oral histone deacetylase inhibitor, entinostat targets growth in cancer cells and resistance pathways that constrain the efficacy of other cancer treatments.

(Source)

Syndax Pharmaceuticals is also developing entinostat as a combination treatment for other oncologic indications with an initial concentration on tumors that have demonstrated sensitivity to immunotherapy, including melanoma, lung cancer, ovarian cancer and triple negative breast cancer.

Entinostat directly affects immune regulatory cells and cancer cells, which has the potential to improve the body’s immune response to tumors. The treatment has a favorable safety profile that has been demonstrated in clinical trials on over 900 patients.

Syndax Pharmaceuticals is currently evaluating entinostat in combination with Keytruda in a Phase 1b/2 clinical trials for lung cancer and melanoma, and they intend to begin Phase 1b/2 clinical trial for entinostat in combination with atexolizumab for triple negative breast cancer. SNDX will also begin similar trials for the drug in combination with avelumab for ovarian cancer.

Leave A Comment