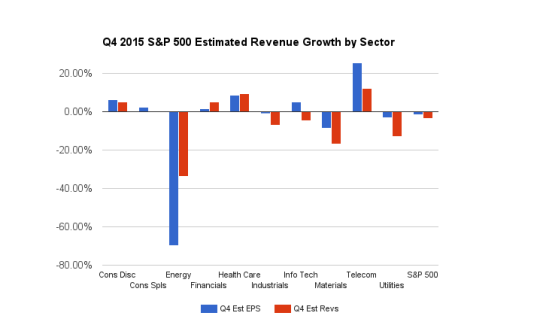

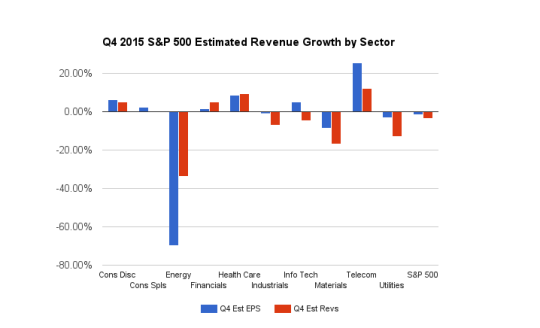

The fourth quarter earnings season, in a word, has been underwhelming. The S&P 500 index reported a decline in profits of 1.8%, with revenues down 3.5%. Those figures make it the worst earnings season since 2009, and firmly put us in a revenue recession, with the last four quarters recording negative sales growth. We also just marked our first down quarter for EPS since the recession, with the next few quarters also predicting negative numbers. Only 55% of companies were able to surpass the Estimize EPS consensus during the fourth quarter, with a much lower 41% beating on the top-line. While the large caps were not able to perform, fundamentals for many of the small caps remained strong.

Small caps, those companies with a market cap under $2B, often don’t have the global exposure that large caps do. Close to 50% of S&P 500 revenues come from overseas. These multinationals have been under severe pressure lately as the global economy weakens, and the strong dollar negatively impacts repatriation of sales from outside the US. Some of the smaller, under the radar stocks, specifically in tech sector, have been a better bet in the current environment. These names often get buried and have limited analyst coverage, but the Estimize Screener accurately identified several companies that were likely to be beats this quarter, and with only a couple of weeks left in the season, there are others with that carry that same bullish signal.

A lot of the wins this quarter were in small cap tech companies. Some of our favorites include those in the enterprise tech space, such as Zendesk (ZEN). Companies are continually investing in the cloud and in their own growth, and Zendesk offers customer service tools and products that are becoming critical for business efficiency. While the company only reported EPS in-line with the Street, revenues beat by a lofty $2.5M, resulting in YoY sales growth of 63% and the eighth consecutive quarter above the 60% mark.

Leave A Comment