Markets and the economy do not need to go in the same direction. Business continues to optimize based on conditions they are seeing. Since the Great Recession, business has done a much better job of adjusting to economic conditions than the masters of the economy have in running the economy.

Business optimization eventually runs out of steam in adjusting to changed conditions IF the economic conditions do not change. This is a contributing factor to the volatility seen in the markets recently.

The role of businesses is to maximize profits. But what happens when you have optimized your company to the crappy domestic and global economy – and sales are flat (or worse)?

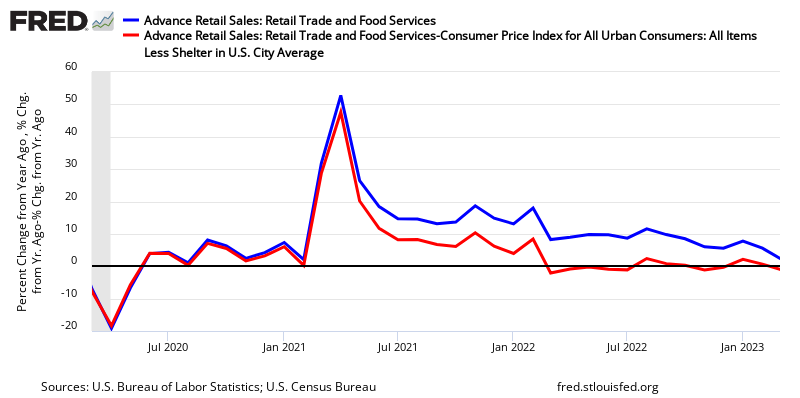

Year-over-Year Change – Unadjusted Retail Sales (blue line) and Inflation Adjusted Retail Sales (red line)

Retail sales have been bouncing around but have been in a general downtrend since 3Q2014. Retail sales per capita seems to be in a long term downtrend (but short term trends vary depending on periods selected – see graph below).

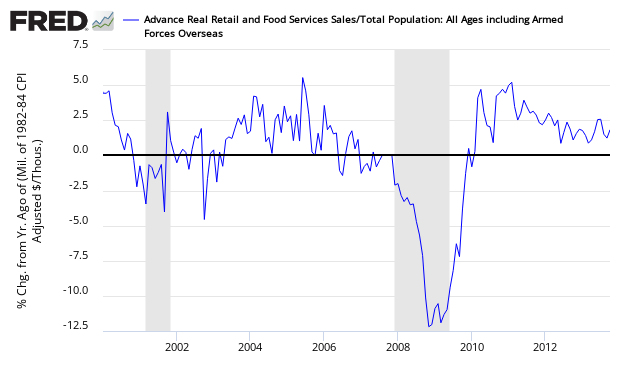

Year-over-Year Change – Per Capita Seasonally Adjusted Retail Sales

You can only squeeze so much profit out of flat sales. One should note that this is average per capita sales – not median sales. If you have followed my previous posts, my theme remains that the upper income quartile is driving consumer spending, and that the lower income quartiles are not spending more (as their incomes are not growing). Companies like Walmart (WMT) will suffer from this phenomenon, BMW will not.

What has happened is that the market valuation has outrun reality.

From Business Insider

Robert Shiller is worried about the stock market.

And the Nobel laureate’s concern can be summed up in this chart, which shows a steady decline in the valuation of the stock market from both institutional and individual buyers.

This chart shows Shiller’s stock market confidence index, which he compiles by asking investors whether they think the stock market is overvalued, fairly valued, or undervalued.

In an interview with the Financial Times, Shiller explains that what worries him about this chart is that the drop in investor confidence corresponds with an increase in the valuation and overall index level of the market.

Said another way, investors keep buying stocks even though they don’t really think stocks are, on balance, a good deal. It is, then, something closer to fear than optimism that is fueling the rally in stocks.

Leave A Comment