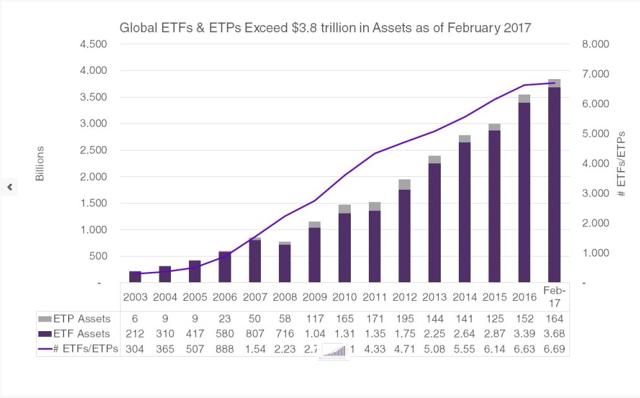

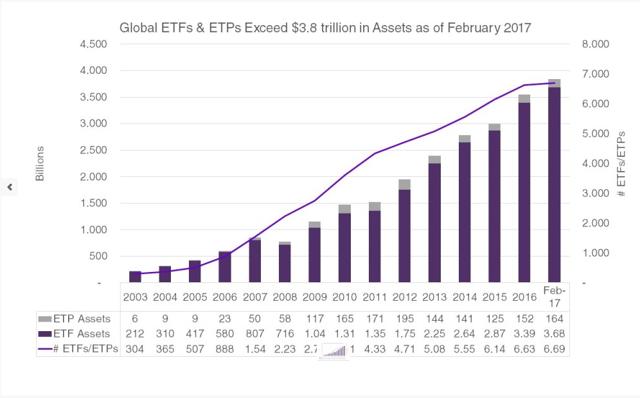

The idea behind the ETF Industry Exposure & Financial Services ETF (TETF) is simple: ETFs are the fastest-growing investment category ever. From a single fund, SPY, in 1993 ETFs now total just over 6,000 different offerings.

ETFs have grown at over an annual rate of 19.4% over the last decade and now have more than $3.8 trillion in assets worldwide!!

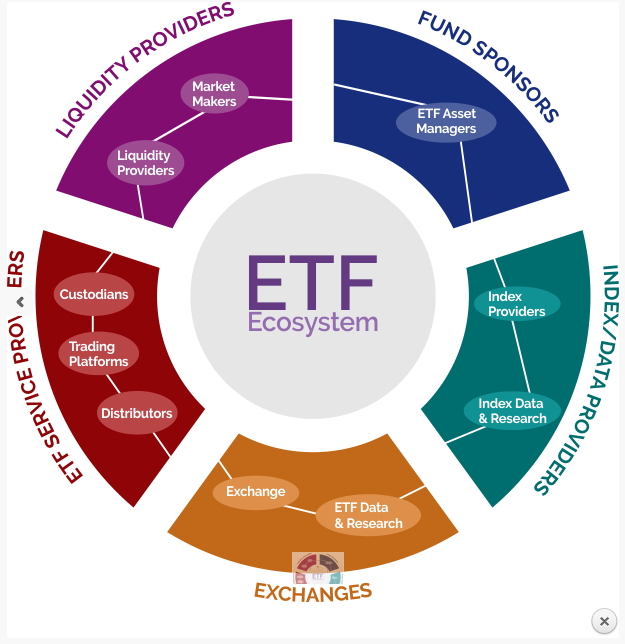

Why not, first, design a passive index that tracks the biggest publicly-traded ETF issuers, the exchanges that benefit from the highest volume of ETF trading, and the various service providers that serve the ETF industry and, second, create an ETF that tracks that index?

The first part was completed courtesy of the Toroso ETF Index. Rather than limit the index solely to those publicly-traded firms that issue ETFs (the “fund sponsors”), however, Toroso includes the financial services firms that provide distribution, custodianship, liquidity and data as well as the actual exchanges that process a higher amount of ETF trades.

The bad news is that, if you are looking for a pure play on ETF issuers, there is no index for that just yet. The good news is that you have far better diversification in an ETF that mirrors this index, which covers a lot of financial services providers as well.

The index is constructed in such a way that fully 50% of the portfolio is comprised of those firms that have “substantial participation” in the ETF marketplace and enjoy a “direct financial impact” from that participation. This tier places 6.25% of the portfolio in each of eight major players:

BlackRock (BLK)

Schwab (SCHW)

Invesco (IVZ)

State Street (STT)

Wisdom Tree (WETF)

MSCI (MSCI)

S&P Global (SPGI), and

CBOE Holdings (CBOE)

This equally-weighted tier is designed to capture those companies with the purest connection to the growth of the ETF industry. (BlackRock alone, via their iShares subsidiary, has aggregated close to 40% of all US ETF assets.) It also includes the CBOE, which is the dominant force in trading and indexing volatility and which derives substantial revenue from the ETF business.

Leave A Comment