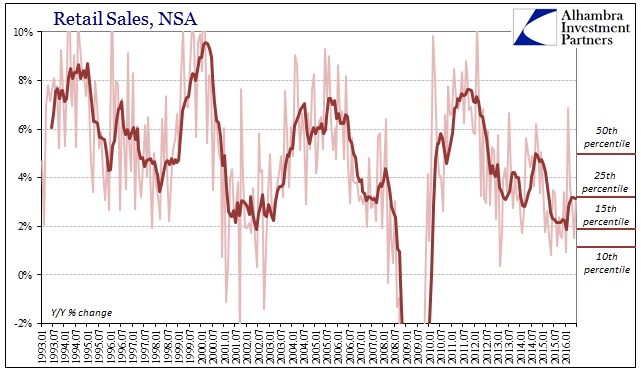

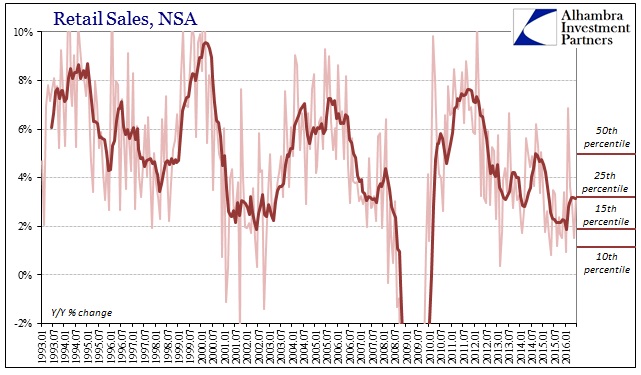

Retail sales in June 2016 were up 3.14% from June 2015. That rate is slightly better than the average from the middle of last year, but not significantly so. The 6-month average continues to straddle the 3% range that traditionally marks recessionary circumstances, about 2% less than the average just before the “rising dollar” economy hit in late 2014. Under actual growth conditions, retail sales should average between 6% and 7% (with the occasional 8% or even 10% month) rather than what we find now of a 3% average (with the occasional 2% or even 0% month).

The real problem with retail sales under these terms is not just the low growth rate but its persistence. As with so many other economic accounts, it is the accumulation of questionably weak results and the relevance in terms of time. Measuring overall retail sales on a 2-year basis demonstrates this point very well:

One year of substandard sales growth is a problem; two years is something else. Realizing that alters how we view and analyze consumer behavior, including the rush to online retailing. Since February, nonstore retail sales have jumped, with growth rates of nearly 10% in February, March, and April followed now by 16% in May and another 14% in June. At the same time, however, sales at general merchandise stores have fallen off to nearly flat; sales at department stores, the largest subcategory of general merchandise, have declined sharply especially in the past two months.

In isolation, that would seem to be the natural even beneficial industry shift from “bricks and mortar” to the more efficient and price positive world of virtual commerce. Given the overall stagnation, two years now, is the sudden greater intensity of that transference a macro concern of consumers being forced to price preferences at the expense of physical shopping?

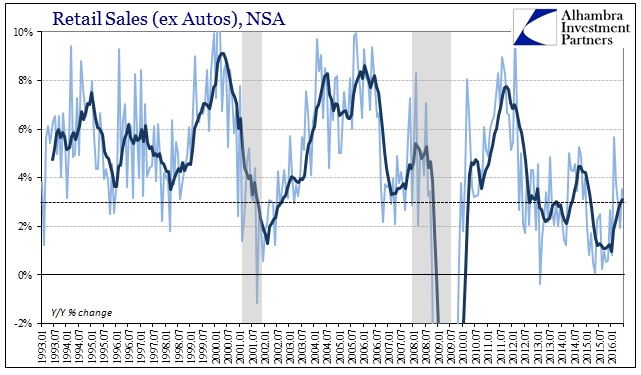

While it’s difficult if not impossible to define exactly the nature of that trend, there are clues in other parts of the retail sales report. Automobile sales have been the one positive in perhaps the whole of the substandard economy especially during the 2012 slowdown period. Even after the initiation of the “rising dollar” economy which further distressed consumer spending, auto sales for the most part remained consistent. That all changed around March 2016, coincident to the surge in nonstore buying.

Leave A Comment