“The end of QE mattered” admits BofAML, adding that “the impact was not replaced by BoJ or ECB dollars.” It is this new ‘hostile’ investment backdrop as liquidity cheer swings to illiquidity fear (and two years of non-stop “pain trades”) that has faith in the big three bull beliefs fading fast. October’s “pain trade” has been a broad-based rally in all risk assets, but there are a number of factors preventing BofAML getting more bullish now that risk has surged.

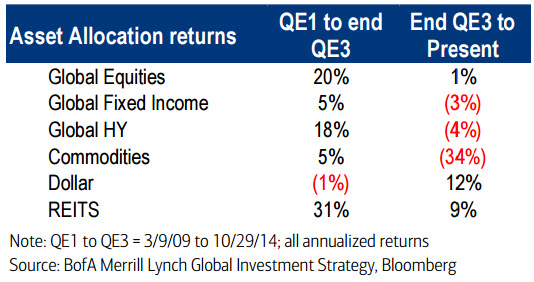

As BofAML writes, annualized total returns from the start of QE1 to the end of QE3 on October 29th 2014: stocks 20%, high yield 18%, REITs 31%. Even commodities rose. Since the end of QE3, global stock markets are up 1%, high yield bonds are down 4% and commodities have slumped 34%. In other words, the end of Fed QE mattered and the impact was not replaced by BoJ or ECB dollars.

This new hostile investment backdrop… Long positions in assets that were losers under QE (US dollar, volatility, banks) have broadly worked, albeit with the crucial exception of the banks. And short positions in assets that were big winners under QE have been rewarded (e.g. high-yielding fixed income assets such as HY, EM debt, MLP’s).

Ironically, while “liquidity” was the bull driver of risk appetite in recent years, in 2015 it is the perception of “illiquidity” in fixed income & equity markets that has become a driver of risk aversion (at a recent client dinner with CIO’s managing over $1 trillion in assets the largest complaint was “lack of liquidity”). This perception has been abetted by a non-stop period of “pain trades” (rapid unwinds of crowded positions).

More recently, recession/default fears driven by US$/oil/China/credit has flipped sentiment from cautious optimism to abject pessimism and bullish positions were cut sharply as faith in the big 3 bull beliefs of the past 18 months faded:

Leave A Comment